SIE vs Series 6

The SIE is the prerequisite exam that tests foundational securities knowledge - anyone can take it without sponsorship. The Series 6 is the limited license for selling mutual funds, variable annuities, and 529 plans - requires the SIE first plus firm sponsorship.

Side-by-Side Comparison

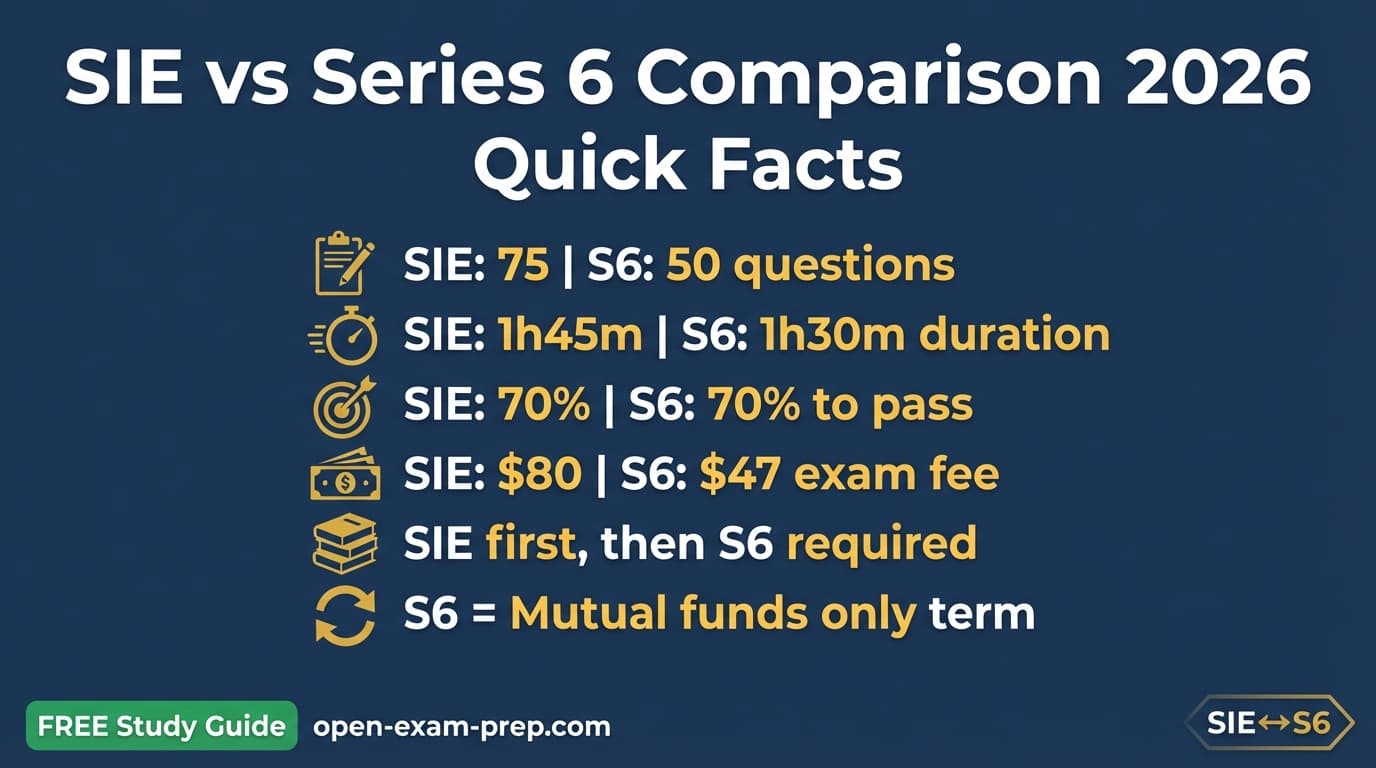

| Feature | SIE | Series 6 |

|---|---|---|

| Full Name | Securities Industry Essentials | Investment Company Products Representative |

| Exam Cost | $80 | $47 |

| Passing Score | 70% | 70% |

| Questions | 75 (70 scored) | 50 (45 scored) |

| Time Limit | 1 hr 45 min | 1 hr 30 min |

| Study Time | 40-60 hours | 30-50 hours |

| Difficulty | Entry-level | Intermediate |

| Prerequisites | None - anyone 18+ can take it | SIE exam + firm sponsorship required |

| Exam Body | FINRA | FINRA |

Key Differences

- 1SIE is a prerequisite; Series 6 is the actual license exam

- 2SIE can be taken without sponsorship; Series 6 requires a firm

- 3SIE costs $80; Series 6 costs only $47

- 4SIE has 75 questions; Series 6 has only 50 questions

- 5SIE tests knowledge; Series 6 tests application for packaged products

- 6SIE valid for 4 years; Series 6 license requires ongoing CE

What Each Exam Allows You To Do

SIE

- Demonstrates foundational securities knowledge

- Required before any FINRA representative exam

- Valid for 4 years without firm sponsorship

- Tests knowledge of securities products, regulations, and industry practices

Series 6

- Sell mutual funds

- Sell variable annuities

- Sell variable life insurance

- Sell 529 education savings plans

- Work at banks, insurance companies, or mutual fund distributors

Who Should Take Each Exam?

Take the SIE if you...

- →Career changers exploring finance

- →College students getting a head start

- →Job seekers wanting to prove securities knowledge

- →Those preparing for Series 6 or Series 7

Take the Series 6 if you...

- →Insurance agents adding securities products

- →Bank investment representatives

- →Those focused on packaged products only

- →Financial services roles at insurance companies

Which Should You Take First?

You MUST take the SIE first. The SIE is required before taking any FINRA representative exam including the Series 6. Take the SIE while job hunting (no sponsorship needed), then secure a position at a firm and take the Series 6 with their sponsorship.

Frequently Asked Questions

QCan I take the Series 6 without the SIE?

No. Since October 2018, the SIE is required before any FINRA representative exam including the Series 6. You must pass the SIE first, then get firm sponsorship to register for Series 6.

QHow long after passing the SIE can I take the Series 6?

Your SIE result is valid for 4 years. You can take the Series 6 anytime within that window, but you'll need firm sponsorship to register. Many people pass the SIE first while job hunting.

QIs Series 6 enough, or should I get Series 7?

It depends on your job. Series 6 is sufficient for selling mutual funds, variable annuities, and 529 plans (common at banks and insurance companies). If you want to sell individual stocks, bonds, and options, you'll need the Series 7 instead.

10 free AI interactions per day

Ready to Start Studying?

Free study materials for both exams - start learning today.

Related Exam Comparisons

Stay Updated

Get free exam tips and study guides delivered to your inbox.