Series 6 vs Series 66

Series 6 and Series 66 serve different purposes and are NOT interchangeable. Series 6 is a federal product license that qualifies you to sell mutual funds and variable contracts. Series 66 is a state-level combined exam (merging Series 63 + 65 content) that provides state registration for BOTH securities sales AND investment advisory services. Critically, Series 66 requires passing Series 7 first - it cannot be paired with Series 6. If you have Series 6, you need Series 63 for state registration, not Series 66.

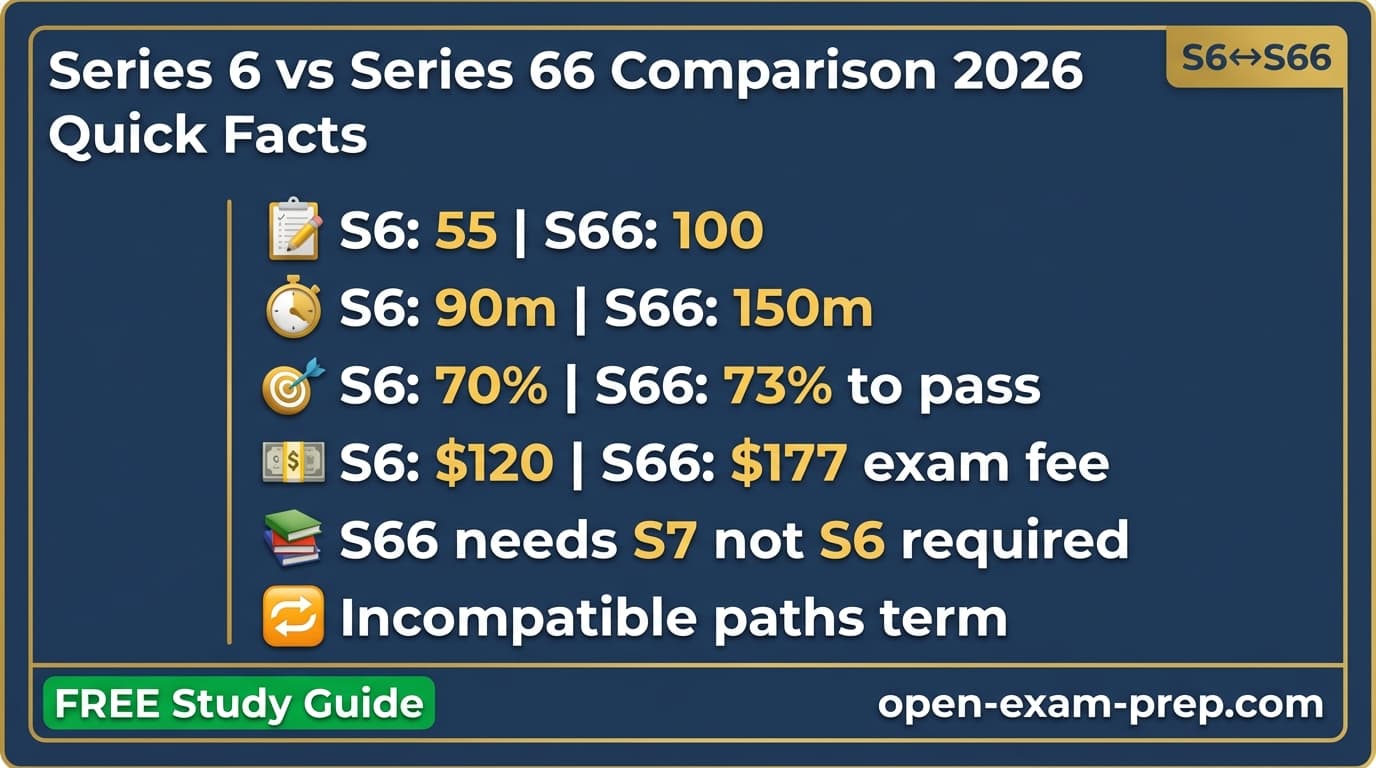

Side-by-Side Comparison

| Feature | Series 6 | Series 66 |

|---|---|---|

| Full Name | Investment Company and Variable Contracts Products Representative | Uniform Combined State Law Examination |

| Exam Cost | $120 | $177 |

| Passing Score | 70% | 73% (73 of 100) |

| Questions | 50 scored + 5 unscored | 100 (85 scored + 15 unscored) |

| Time Limit | 90 minutes | 150 minutes |

| Study Time | 30-50 hours | 30-50 hours |

| Difficulty | Moderate | Moderate |

| Prerequisites | SIE exam + firm sponsorship | Must pass Series 7 (NOT Series 6) |

| Exam Body | FINRA | NASAA (administered by FINRA) |

Key Differences

- 1Series 6 is a federal product license; Series 66 is a combined state registration exam

- 2Series 66 requires Series 7 as prerequisite; it cannot be combined with Series 6

- 3Series 6 + 63 is the typical combo; Series 7 + 66 is the alternative path

- 4Series 66 combines Series 63 + 65 content into one exam

- 5Series 6 limits products; Series 7 + 66 gives full securities + advisory authority

- 6Series 66 costs $177; Series 6 costs $120

What Each Exam Allows You To Do

Series 6

- Sell mutual funds

- Sell variable annuities and life insurance

- Sell unit investment trusts

- Earn commissions on packaged products

Series 66

- State registration as agent (like Series 63)

- State registration as IAR (like Series 65)

- Provide fee-based advice

- Sell securities in registered states

Who Should Take Each Exam?

Take the Series 6 if you...

- →Insurance agents expanding to investments

- →Bank representatives

- →Those in commission-based sales

- →Entry-level securities roles

Take the Series 66 if you...

- →Series 7 holders wanting dual capability

- →Financial advisors at wirehouses

- →Those wanting commission AND fee income

- →Hybrid advisory practices

Which Should You Take First?

You cannot directly combine Series 6 and Series 66 - they're incompatible paths. If you're getting Series 6, pair it with Series 63 for state registration. If you want the broader capabilities that Series 66 provides (both state agent registration AND investment adviser registration), you must take Series 7 instead of Series 6. The decision is really between: Path A (Series 6 + 63 = limited products, commission-only) or Path B (Series 7 + 66 = full products + advisory fees).

Frequently Asked Questions

QCan I take Series 66 if I only have Series 6?

No. Series 66 explicitly requires passing the Series 7 as a prerequisite - it cannot be combined with Series 6. This is because Series 66 includes investment adviser content (from Series 65) that assumes broader product knowledge than Series 6 provides. If you have Series 6, your state registration option is Series 63, not Series 66.

QWhat's the difference between Series 6 + 63 versus Series 7 + 66?

Series 6 + 63 limits you to selling packaged products (mutual funds, variable annuities) for commissions only. Series 7 + 66 allows you to sell ALL securities (including individual stocks and bonds) AND provide fee-based investment advice as a fiduciary. Series 7 + 66 is more comprehensive but requires more study time and a harder exam. The choice depends on whether your career needs the broader capabilities.

QShould I upgrade from Series 6 to Series 7 to get Series 66?

Consider upgrading if you want to: 1) sell individual stocks and bonds, 2) charge advisory fees instead of just commissions, or 3) work at firms that require Series 7. The Series 7 is significantly harder than Series 6 (125 questions vs 50, more content). If your career stays focused on mutual funds and insurance products, Series 6 + 63 may be sufficient and saves study time.

QWhy does Series 66 require Series 7 but not Series 6?

Series 66 combines state securities law (from Series 63) with investment adviser law (from Series 65). The investment adviser content assumes knowledge of a full range of securities, which Series 7 covers but Series 6 doesn't. Since Series 6 only covers packaged products, it doesn't provide the foundation needed for the advisory component of Series 66. This is why NASAA requires Series 7 specifically.

10 free AI interactions per day

Ready to Start Studying?

Free study materials for both exams - start learning today.

Related Exam Comparisons

Stay Updated

Get free exam tips and study guides delivered to your inbox.