CFP vs Series 65

The Series 65 is the legal LICENSE required to give investment advice for fees. The CFP is a professional CERTIFICATION that demonstrates comprehensive planning expertise. Key insight: CFP holders can typically waive the Series 65 exam requirement, but the CFP alone isn't a license - you still need to register as an IAR.

Side-by-Side Comparison

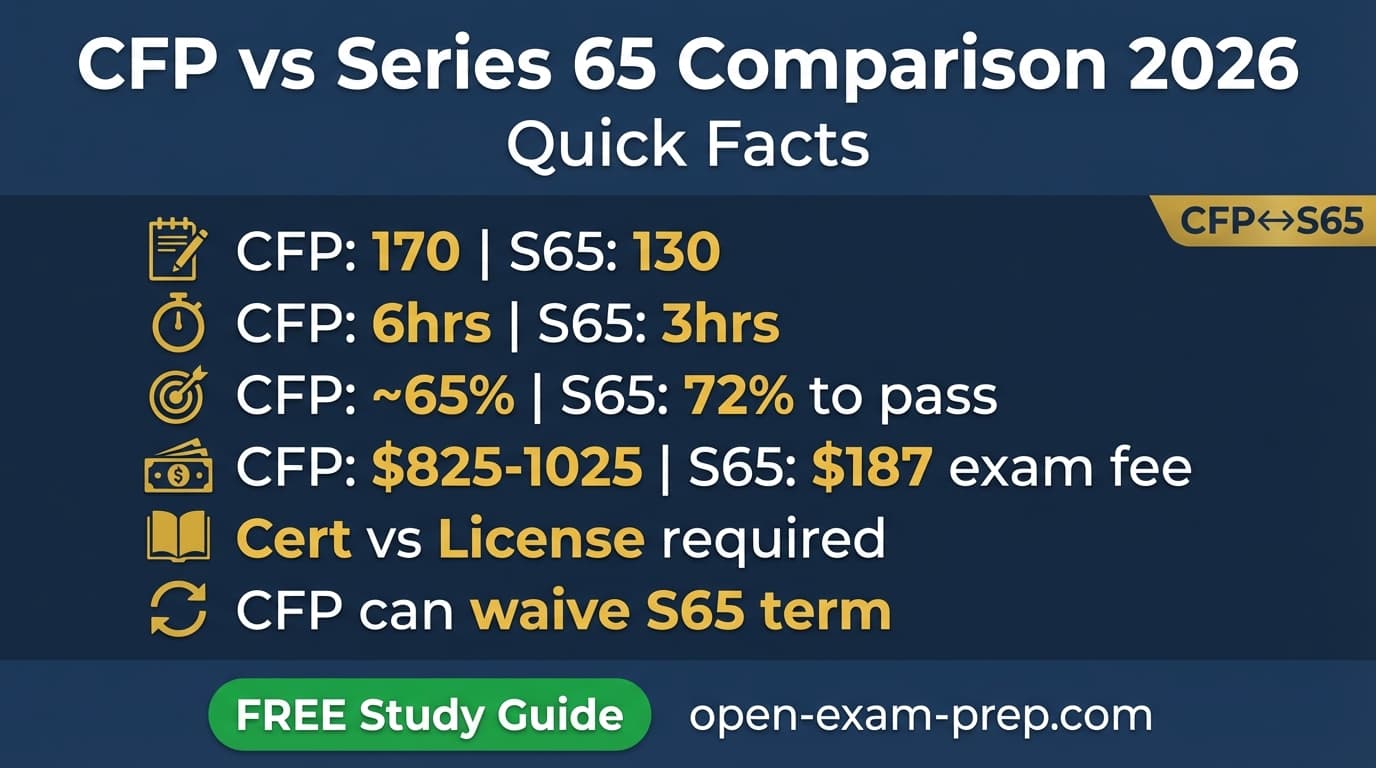

| Feature | CFP | Series 65 |

|---|---|---|

| Full Name | Certified Financial Planner | Uniform Investment Adviser Law |

| Exam Cost | $825-$1,025 | $187 |

| Passing Score | ~65% | 72% |

| Questions | 170 | 130 (120 scored) |

| Time Limit | 6 hours (two 3-hr sessions) | 3 hours |

| Study Time | 250-400 hours | 60-80 hours |

| Difficulty | Very Challenging | Challenging |

| Prerequisites | Bachelor's degree + CFP coursework + experience | None - no SIE required |

| Exam Body | CFP Board | NASAA |

Key Differences

- 1Series 65 = LICENSE (legal authority); CFP = CERTIFICATION (credential)

- 2Series 65 is required to practice; CFP is 'nice to have' for credibility

- 3Series 65: $187 and 60-80 hours; CFP: $825-1,025 and 250-400 hours

- 4CFP requires bachelor's degree + coursework + 4,000-6,000 experience hours

- 5Series 65 has no prerequisites - truly standalone

- 6CFP can waive Series 65 exam in most states

- 7CFP covers 8 planning areas; Series 65 focuses on investments + regulations

What Each Exam Allows You To Do

CFP

- Use the prestigious CFP® designation

- Demonstrate comprehensive financial planning competency

- May waive Series 65 requirement in most states

- Work as a holistic financial planner

- Higher credibility and client trust

Series 65

- Work as an Investment Adviser Representative (IAR)

- Legally provide investment advice for a fee

- Work at RIAs (Registered Investment Advisers)

- Manage client portfolios

- Required license for fee-based advisory

Who Should Take Each Exam?

Take the CFP if you...

- →Career financial planners

- →Those wanting the gold standard credential

- →Advisors building trust with clients

- →Those pursuing comprehensive planning

Take the Series 65 if you...

- →Career changers entering advisory

- →Those needing quick licensure

- →Fee-only advisors at RIAs

- →CFP candidates needing immediate licensure

Which Should You Take First?

Start with Series 65 to get licensed immediately, then pursue CFP for credibility. OR pursue CFP first if you have time (18-24 months) - it can waive the Series 65 exam. For quickest path to working at an RIA, Series 65 is faster ($187, 4-8 weeks of study vs. CFP's 18-24 month journey).

Frequently Asked Questions

QDoes CFP replace Series 65?

CFP holders can typically waive the Series 65 EXAM requirement in most states. However, you must still register as an IAR with your state - the CFP alone isn't a license to practice. Check your specific state's waiver requirements.

QWhich is harder: CFP or Series 65?

The CFP is significantly harder - 170 questions over 6 hours, ~65% pass rate, requiring 250-400 hours of study plus mandatory coursework and experience. Series 65 is 130 questions in 3 hours, 60-80 hours of study, no prerequisites.

QCan I start working with just Series 65?

Yes! The Series 65 is sufficient to work as an IAR at an RIA. Many advisors start with Series 65 to begin working immediately, then pursue CFP over time for career advancement and credibility.

QWhich is better for my career?

Both serve different purposes. Series 65 is the legal minimum to practice. CFP is the industry gold standard that builds client trust. For best outcomes, have both - Series 65 for legal authority, CFP for professional credibility.

10 free AI interactions per day

Ready to Start Studying?

Free study materials for both exams - start learning today.

Related Exam Comparisons

Stay Updated

Get free exam tips and study guides delivered to your inbox.