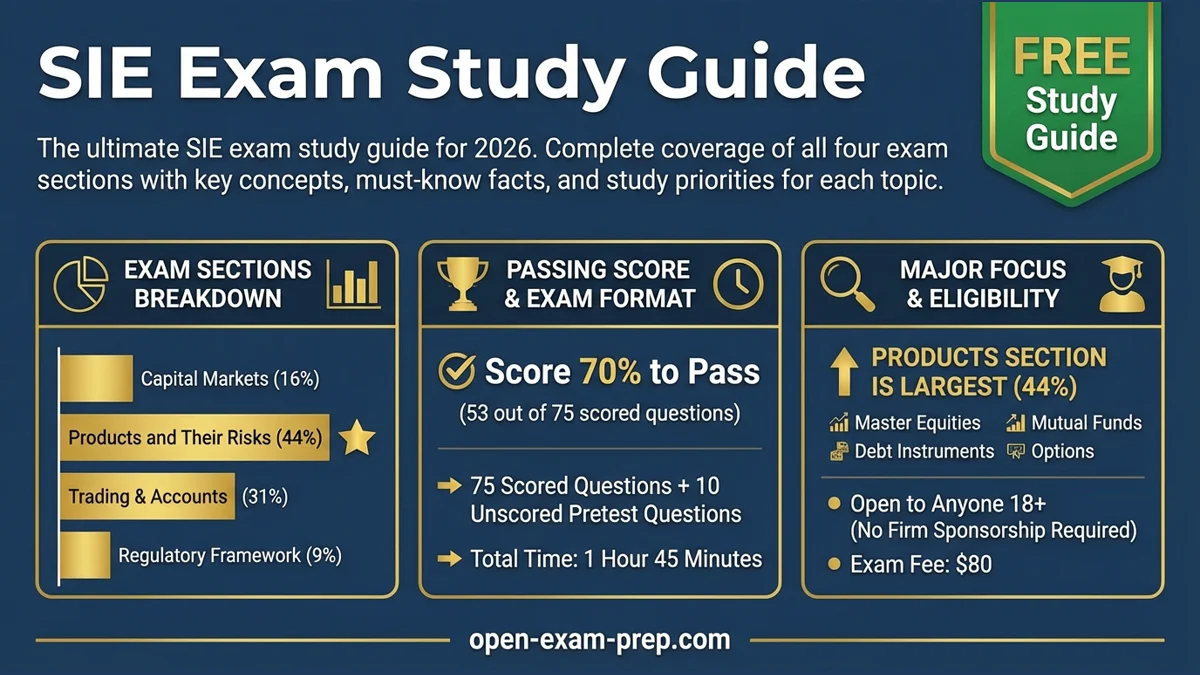

Complete SIE Exam Study Guide for 2026

This comprehensive study guide covers every topic on the SIE exam. Use it as your roadmap to pass the Securities Industry Essentials exam on your first attempt.

500+ free SIE questionsPractice questions with detailed explanations

SIE Exam Structure at a Glance

| Section | Weight | Questions | Study Priority |

|---|---|---|---|

| Knowledge of Capital Markets | 16% | ~12 | Medium |

| Understanding Products and Their Risks | 44% | ~33 | Highest |

| Trading, Customer Accounts, Prohibited Activities | 31% | ~23 | High |

| Overview of Regulatory Framework | 9% | ~7 | Medium |

Total: 75 scored questions + 10 unscored = 85 questions in 105 minutes

Section 1: Knowledge of Capital Markets (16%)

This section tests your understanding of how markets work, economic factors, and regulatory entities.

1.1 Regulatory Entities and Their Functions

Key Regulators to Know:

| Regulator | Function | Jurisdiction |

|---|---|---|

| SEC | Federal securities regulator | Enforces securities laws, registers securities |

| FINRA | Self-regulatory organization | Regulates broker-dealers and registered reps |

| MSRB | Municipal securities rulemaker | Creates rules for municipal securities |

| Federal Reserve | Central bank | Monetary policy, Reg T margin rules |

| State Regulators | State-level oversight | "Blue sky" laws, agent registration |

FINRA's Role:

- Registers representatives and broker-dealers

- Writes and enforces conduct rules

- Operates arbitration and mediation

- Administers qualification exams (including the SIE)

SEC's Role:

- Enforces federal securities laws

- Requires registration of securities

- Oversees national exchanges

- Investigates fraud and manipulation

1.2 Market Structure

Primary vs. Secondary Markets:

- Primary Market: New securities issued (IPOs, new bond offerings)

- Secondary Market: Existing securities traded (NYSE, NASDAQ)

Types of Markets:

- Exchanges: NYSE, NASDAQ - centralized trading venues

- OTC Market: Over-the-counter, dealer network for unlisted securities

- Alternative Trading Systems (ATS): Dark pools, ECNs

Market Participants:

- Broker: Agent who executes orders for customers (earns commission)

- Dealer: Principal who trades from own inventory (earns markup/markdown)

- Broker-Dealer: Firm that acts as both

- Market Maker: Dealer obligated to provide liquidity

1.3 Economic Factors

Key Economic Indicators:

| Indicator | What It Measures | Leading/Lagging |

|---|---|---|

| GDP | Total economic output | Coincident |

| Unemployment Rate | Joblessness | Lagging |

| CPI | Consumer inflation | Lagging |

| Housing Starts | New construction | Leading |

| Stock Market | Investor sentiment | Leading |

Interest Rate Relationships:

- Fed raises rates → Bond prices fall, borrowing costs rise

- Fed lowers rates → Bond prices rise, borrowing costs fall

- Inflation rising → Fed likely to raise rates

- Recession concerns → Fed likely to lower rates

Business Cycle Phases:

- Expansion - Growth, low unemployment

- Peak - Maximum growth

- Contraction - Declining growth

- Trough - Minimum growth, recovery begins

Section 2: Understanding Products and Their Risks (44%)

This is the most important section - it's 44% of your exam score.

2.1 Equity Securities

Common Stock:

- Represents ownership in a corporation

- Voting rights (typically one vote per share)

- Last in liquidation priority

- Dividends not guaranteed

- Unlimited upside potential

Preferred Stock:

- Fixed dividend rate

- Priority over common in dividends and liquidation

- Usually no voting rights

- Price more sensitive to interest rates than common

Rights and Warrants:

- Rights: Short-term (30-60 days), allow existing shareholders to buy new shares below market

- Warrants: Long-term (years), allow holder to buy shares at fixed price, often attached to bonds

American Depositary Receipts (ADRs):

- U.S.-traded certificates representing foreign stock

- Dividends paid in U.S. dollars

- Subject to currency risk

2.2 Debt Securities

Corporate Bonds:

- Debt obligation of a corporation

- Fixed interest payments (coupon)

- Par value typically $1,000

- Credit risk varies by issuer rating

Bond Ratings:

| Investment Grade | Speculative (Junk) |

|---|---|

| AAA, AA, A, BBB (S&P) | BB, B, CCC, CC, C, D |

| Aaa, Aa, A, Baa (Moody's) | Ba, B, Caa, Ca, C |

Government Securities:

| Security | Maturity | Interest | Taxability |

|---|---|---|---|

| T-Bills | Up to 1 year | Discount (no coupon) | State tax exempt |

| T-Notes | 2-10 years | Semi-annual coupon | State tax exempt |

| T-Bonds | 10-30 years | Semi-annual coupon | State tax exempt |

| TIPS | Various | Inflation-adjusted | State tax exempt |

Municipal Bonds:

- Issued by state/local governments

- Interest exempt from federal income tax

- May be exempt from state tax if issued in your state

- GO Bonds: Backed by taxing power

- Revenue Bonds: Backed by project revenue

Bond Price vs. Yield Relationship:

- Interest rates UP → Bond prices DOWN

- Interest rates DOWN → Bond prices UP

- Premium bond: Trading above par (coupon > market rate)

- Discount bond: Trading below par (coupon < market rate)

2.3 Packaged Products

Mutual Funds:

- Pooled investment managed by professional manager

- Diversification benefits

- Priced once daily at NAV (Net Asset Value)

- Open-end: Continuous offering, redeemable at NAV

- Closed-end: Fixed number of shares, trades on exchange

Mutual Fund Share Classes:

| Class | Front-End Load | Back-End Load | 12b-1 Fees | Best For |

|---|---|---|---|---|

| A Shares | Yes (up to 5.75%) | No | Low | Large investments, long-term |

| B Shares | No | Yes (decreasing) | Higher | Medium investments |

| C Shares | No | Small (1 year) | Highest | Short-term (1-3 years) |

Exchange-Traded Funds (ETFs):

- Trade on exchanges like stocks

- Typically track an index

- Lower expense ratios than mutual funds

- Can be bought/sold throughout the day

- May trade at premium or discount to NAV

Unit Investment Trusts (UITs):

- Fixed portfolio (not actively managed)

- Self-liquidating at termination date

- Lower fees than mutual funds

- No rebalancing

Variable Annuities:

- Insurance contract with investment component

- Tax-deferred growth

- Separate account for investments

- Death benefit guarantee

- Surrender charges for early withdrawal

2.4 Options (Basics)

Call Options:

- Right to BUY at the strike price

- Buyer is bullish (wants price to rise)

- Seller is bearish or neutral

Put Options:

- Right to SELL at the strike price

- Buyer is bearish (wants price to fall)

- Seller is bullish or neutral

Basic Options Positions:

| Position | View | Max Gain | Max Loss |

|---|---|---|---|

| Long Call | Bullish | Unlimited | Premium |

| Short Call | Bearish | Premium | Unlimited |

| Long Put | Bearish | Strike - Premium | Premium |

| Short Put | Bullish | Premium | Strike - Premium |

Key Options Terms:

- Premium: Price paid for the option

- Strike Price: Price at which option can be exercised

- Expiration: Third Friday of expiration month

- In the Money: Option has intrinsic value

- Out of the Money: Option has no intrinsic value

2.5 Alternative Investments

Real Estate Investment Trusts (REITs):

- Must distribute 90%+ of income as dividends

- Provides exposure to real estate

- Trades on exchanges (equity REITs)

- Dividends generally taxed as ordinary income

Direct Participation Programs (DPPs):

- Limited partnerships for oil/gas, real estate, equipment leasing

- Pass-through taxation (K-1 forms)

- Illiquid, long-term investments

- Risks include lack of liquidity and potential loss of capital

Hedge Funds:

- Private investment pools for accredited investors

- Use aggressive strategies (short selling, leverage, derivatives)

- High minimum investments

- Limited liquidity

free SIE practice questionsPractice questions with detailed explanations

Section 3: Trading, Customer Accounts, and Prohibited Activities (31%)

3.1 Customer Account Types

Individual Accounts:

- Single owner

- Only account holder can make decisions

Joint Accounts:

- JTWROS (Joint Tenants with Rights of Survivorship): Asset passes to survivor

- TIC (Tenants in Common): Asset passes to estate

Retirement Accounts:

- Traditional IRA: Tax-deductible contributions, taxable withdrawals

- Roth IRA: After-tax contributions, tax-free qualified withdrawals

- 401(k): Employer-sponsored, pre-tax contributions, matching possible

Custodial Accounts:

- UGMA/UTMA for minors

- Custodian manages until minor reaches age of majority

- Assets belong to minor (irrevocable gift)

Margin Accounts:

- Allows borrowing to purchase securities

- Reg T requires 50% initial margin

- Maintenance margin: 25% for long, 30% for short

- Interest charged on borrowed funds

3.2 Order Types

Market Orders:

- Execute immediately at current price

- Guaranteed execution, not price

Limit Orders:

- Buy limit: Maximum price you'll pay

- Sell limit: Minimum price you'll accept

Stop Orders:

- Buy stop: Triggered when price rises to stop price

- Sell stop: Triggered when price falls to stop price

- Becomes market order when triggered

Time Qualifications:

- Day Order: Expires at market close

- GTC (Good Till Cancelled): Remains until executed or cancelled

- IOC (Immediate or Cancel): Fill immediately or cancel

- FOK (Fill or Kill): Fill entire order immediately or cancel all

3.3 Trade Settlement

| Security Type | Settlement |

|---|---|

| Corporate stocks/bonds | T+1 (next business day) |

| Municipal bonds | T+1 |

| Government securities | T+1 |

| Options | T+1 |

| Mutual funds | T+1 |

3.4 Prohibited Activities

Insider Trading:

- Trading on material, non-public information

- Applies to insiders and those who receive "tips"

- Both tipper and tippee liable

Market Manipulation:

- Churning: Excessive trading to generate commissions

- Front-Running: Trading ahead of customer orders

- Marking the Close: Trading to influence closing price

- Painting the Tape: Creating false appearance of activity

Other Prohibited Practices:

- Selling Away: Selling securities outside firm approval

- Unauthorized Trading: Trading without customer permission

- Misrepresentation: False or misleading statements

- Guarantee Against Loss: Promising no loss (prohibited)

3.5 Suitability

Know Your Customer (KYC): Before making recommendations, understand:

- Investment objectives

- Time horizon

- Risk tolerance

- Financial situation

- Tax status

- Liquidity needs

Suitability Obligations:

- Reasonable basis suitability (understand the product)

- Customer-specific suitability (suitable for this customer)

- Quantitative suitability (not excessive trading)

Section 4: Overview of Regulatory Framework (9%)

4.1 Securities Acts

Securities Act of 1933:

- Regulates new issues (primary market)

- Requires registration or exemption

- Full and fair disclosure via prospectus

- "Truth in Securities" law

Securities Exchange Act of 1934:

- Regulates secondary market trading

- Created the SEC

- Regulates broker-dealers and exchanges

- Requires periodic reporting (10-K, 10-Q)

Investment Company Act of 1940:

- Regulates mutual funds and investment companies

- Requirements for registration and operation

- Shareholder protections

Investment Advisers Act of 1940:

- Regulates investment advisers

- Registration requirements

- Fiduciary duty to clients

4.2 SRO Rules and Regulations

FINRA Registration:

- Form U4 for individuals (registration)

- Form U5 for termination

- Background checks and fingerprinting

- CE requirements

Continuing Education:

- Regulatory Element: Computer-based training, within 120 days of anniversary

- Firm Element: Annual, firm-developed training

Conduct Rules:

- Just and equitable principles of trade

- Reasonable supervision

- Proper use of customer funds and securities

- Books and records requirements

4.3 Communications with the Public

Types of Communications:

| Type | Definition | Approval Required |

|---|---|---|

| Retail Communication | Any written to 25+ retail investors | Principal pre-approval |

| Correspondence | Written to 25 or fewer retail investors | Supervision required |

| Institutional Communication | Written only to institutional investors | Less stringent review |

Content Standards:

- Must be fair, balanced, and not misleading

- Claims must be supported

- Risk disclosure required

- No predictions of future performance

SIE Exam Study Schedule

| Week | Focus Areas | Hours |

|---|---|---|

| 1 | Equity securities, debt securities | 10-12 |

| 2 | Packaged products, options basics | 10-12 |

| 3 | Customer accounts, order types, settlement | 8-10 |

| 4 | Prohibited activities, suitability | 8-10 |

| 5 | Capital markets, economic factors, regulations | 6-8 |

| 6 | Practice exams, weak area review | 8-10 |

Quick Reference: Must-Know Numbers

| Concept | Number |

|---|---|

| SIE passing score | 70% (53/75) |

| SIE exam fee | $80 |

| SIE time limit | 105 minutes |

| Reg T margin requirement | 50% |

| Long margin maintenance | 25% |

| Short margin maintenance | 30% |

| Options contract size | 100 shares |

| Options expiration | 3rd Friday of month |

| Trade settlement (most securities) | T+1 |

| SIE validity period | 4 years |

| CE Regulatory Element | Within 120 days of 2nd anniversary |

Start Practicing Today

Ready to test your knowledge? Here's how to continue your preparation:

Free SIE Practice Questions

- 500+ exam-style questions covering all four sections

- Detailed explanations for every answer

- AI tutor to explain any concept you're struggling with

- Progress tracking by topic area

More SIE Study Resources

- How to Pass the SIE Exam on Your First Try - 10 proven strategies

- SIE Exam Pass Rate 2026 - Understand the statistics

- How Long to Study for the SIE - Plan your timeline

- Best SIE Exam Prep Courses 2026 - Compare options

- Financial Terms Glossary - Look up any term you don't know

Planning for What's Next?

After passing the SIE, you'll need a top-off exam. Compare your options:

- SIE vs Series 7 - The most popular path

- Series 6 vs Series 7 - Limited vs full license

Key Takeaways

- Products section (44%) is your priority - master it first

- Know the regulators - SEC, FINRA, MSRB, state authorities

- Understand bond price/yield relationship - inverse relationship

- Learn prohibited activities - insider trading, churning, front-running

- Memorize key numbers - margin requirements, settlement, passing score

This study guide covers all the major topics on the SIE exam. Use it alongside practice questions for the best results.

Good luck with your SIE exam preparation!