Pennsylvania Life & Health Insurance License Exam Overview

The Pennsylvania Life & Health Insurance License Exam is administered by Prometric on behalf of the Pennsylvania Insurance Department (PID). Pennsylvania is the fifth-largest state by population, with Philadelphia and Pittsburgh serving as major financial and healthcare centers.

Passing this exam qualifies you to sell life insurance, health insurance, annuities, and related products throughout the Commonwealth—a state with nearly 13 million residents and a robust economy centered on healthcare, education, manufacturing, and financial services.

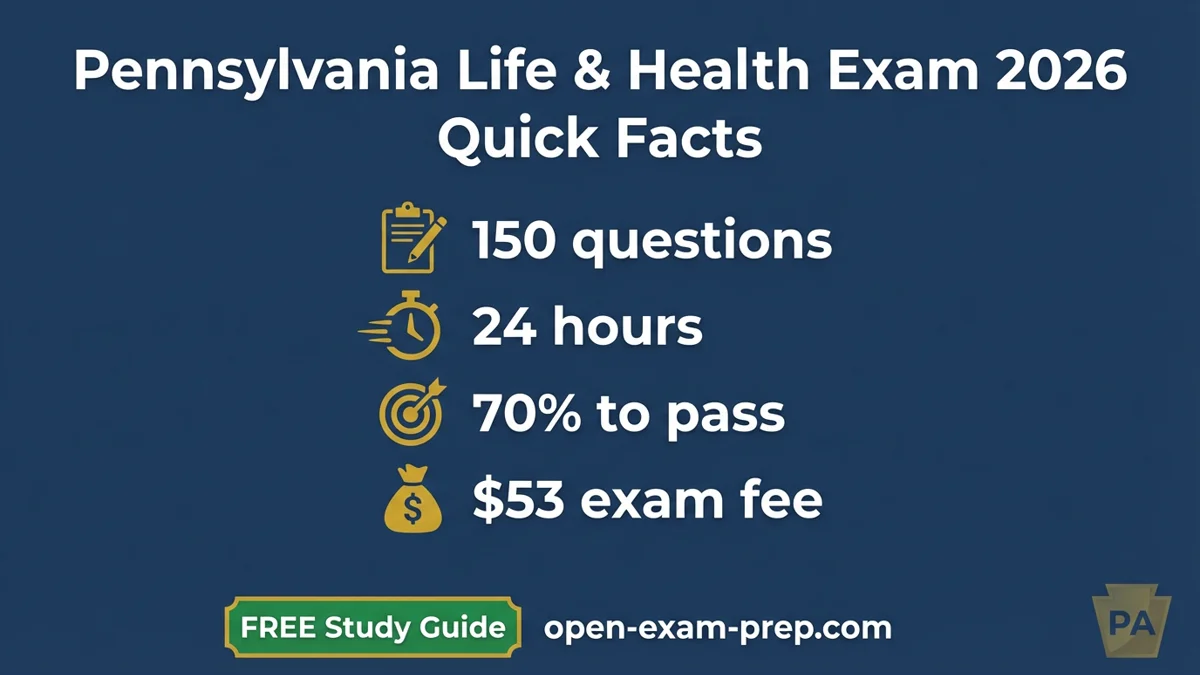

Exam Format at a Glance

| Component | Details |

|---|---|

| Total Questions | 150 multiple-choice |

| Scored Questions | 150 |

| Time Limit | 2 hours 50 min |

| Passing Score | 70% (105 correct answers) |

| Testing Vendor | PSI |

| Exam Fee | $53 (combined Life & Health) |

| Pre-licensing Education | Not required (as of 04/29/2025) |

Why Get Licensed in Pennsylvania?

- Large population base — Nearly 13 million potential clients

- Major healthcare hub — Leading hospital systems and health insurers

- CHIP pioneer — Pennsylvania created children's health insurance

- Multi-state opportunity — Easy reciprocity with neighboring states

- Competitive compensation — Average agent salary over $65,000

📚 Start Your FREE Pennsylvania Life & Health Exam Prep

Ready to begin studying? Our comprehensive, completely free Pennsylvania Life & Health exam prep covers everything you need to pass.

Key Topics Covered on the Exam

1. Life Insurance Fundamentals (30-35%)

Types of Life Insurance:

- Term Life (level, decreasing, renewable, convertible)

- Whole Life (ordinary, limited pay, single premium)

- Universal Life (flexible premiums, adjustable death benefit)

- Variable Life (securities-based, separate account)

Policy Provisions Under Pennsylvania Law:

| Provision | Pennsylvania Requirement |

|---|---|

| Grace Period | 31 days minimum |

| Incontestability | 2 years |

| Suicide Clause | 2 years |

| Free Look Period | 10 days (30 days for seniors 65+) |

| Reinstatement | 3 years |

| Misstatement of Age | Adjustment of benefits |

Beneficiary Designations:

- Primary and contingent beneficiaries

- Revocable vs. irrevocable designations

- Per stirpes vs. per capita distribution

- Pennsylvania inheritance and estate considerations

2. Health Insurance Fundamentals (30-35%)

Major Medical Coverage:

- Deductibles, copays, coinsurance

- Out-of-pocket maximums

- Network types (HMO, PPO, EPO, POS)

- Essential health benefits under ACA

Pennsylvania-Specific Health Topics:

- Pennie marketplace (state-based exchange)

- CHIP (Pennsylvania pioneered this program!)

- Medical Assistance (Pennsylvania Medicaid)

- Act 68 (HMO Act requirements)

Disability Income Insurance:

- Short-term vs. long-term disability

- Own occupation vs. any occupation definitions

- Elimination periods and benefit periods

- Social Security integration

Long-Term Care Insurance:

- Benefit triggers (ADLs, cognitive impairment)

- Pennsylvania Long-Term Care Partnership

- Tax-qualified policies

- Inflation protection options

3. Annuities (15-20%)

- Fixed vs. variable annuities

- Immediate vs. deferred annuities

- Accumulation and annuitization phases

- Pennsylvania annuity suitability requirements

- Surrender charges and free withdrawal provisions

- 1035 exchanges and tax implications

4. Pennsylvania Insurance Code and Regulations (15-20%)

Title 40 (Insurance) Key Provisions:

- Producer licensing requirements

- Unfair Insurance Practices Act

- Unfair claims settlement practices

- Replacement regulations

- Advertising guidelines

Licensing Requirements:

- Pre-licensing education: Not required (as of 04/29/2025, previously 24 hours)

- Continuing education: 24 hours every 2 years

- Ethics requirement: 3 hours included in CE

- Background check and fingerprinting required (IdentoGO)

Producer Responsibilities:

- Fiduciary duties to clients

- Premium handling requirements

- Record retention (5 years)

- Reporting changes within 30 days

5. Ethics and Professional Conduct (10-15%)

- Suitability and needs analysis

- Disclosure requirements

- Privacy and confidentiality (HIPAA compliance)

- Anti-rebating and anti-twisting rules

- Handling complaints and grievances

Study Timeline for Success

| Week | Focus Area | Hours |

|---|---|---|

| Week 1-2 | Life insurance products and provisions | 12-15 |

| Week 2-3 | Health insurance and ACA | 12-15 |

| Week 3-4 | Annuities and specialty products | 8-10 |

| Week 4-5 | Pennsylvania regulations (Title 40) | 8-10 |

| Week 5-6 | Practice exams and review | 12-15 |

Total recommended study time: 55-65 hours

🎯 Free Practice Questions Available

Test your knowledge with hundreds of free practice questions designed specifically for the Pennsylvania Life & Health exam.

Pennsylvania-Specific Exam Tips

1. Know Your Pennsylvania Laws

The exam tests Pennsylvania-specific regulations:

- Title 40 — Pennsylvania Insurance Code

- Pennie — State health insurance marketplace

- Act 68 — HMO Act requirements

- CHIP — Children's health coverage (PA pioneered this!)

2. Master the Numbers

| Topic | Pennsylvania Requirement |

|---|---|

| Grace period | 31 days |

| Free look period | 10 days (30 for 65+) |

| Incontestability | 2 years |

| CE requirement | 24 hours/2 years |

| Pre-licensing | Not required (as of 04/29/2025) |

| Passing score | 70% |

| Record retention | 5 years |

3. Understand Pennie Marketplace

Pennsylvania's state-based health insurance marketplace:

- Open enrollment periods (November-January)

- Special enrollment qualifications

- Subsidy and tax credit eligibility

- Plan tier options (Bronze through Platinum)

4. Focus on Senior Protections

Pennsylvania has enhanced rules for seniors:

- Extended free look period (30 days for 65+)

- Annuity suitability requirements

- Medicare supplement regulations

- Long-term care disclosure requirements

Common Mistakes to Avoid

- Underestimating Pennsylvania regulations — State-specific laws are heavily tested

- Forgetting CHIP history — Pennsylvania pioneered children's health coverage

- Skipping health insurance — It's equal weight to life insurance

- Ignoring senior protections — PA has enhanced rules for older consumers

- Not practicing timed exams — 2.5 hours for 150 questions requires pacing

- Cramming last minute — Spread study over 5-6 weeks

After Passing Your Exam

- Apply for license through NIPR or PA Insurance Department

- Complete fingerprinting at IdentoGO location

- Pay license fee — $55 for resident license

- Affiliate with insurer — Get appointed by carrier

- Maintain CE compliance — 24 hours every 2 years

- Begin selling — Your license is valid for 2 years

2026 Pennsylvania Updates

For 2026, be aware of:

- Pennie marketplace updates and plan changes

- Enhanced telehealth coverage requirements

- Updated producer appointment rules

- Modified replacement regulation guidance

Start Your Pennsylvania Insurance Career Today

The Pennsylvania Life & Health license opens doors to one of the nation's largest insurance markets. With proper preparation, you can pass the exam on your first attempt.

Our free study materials include:

- ✅ Complete topic coverage

- ✅ Practice questions with explanations

- ✅ Pennsylvania-specific regulations (Title 40)

- ✅ Study guides and summaries

- ✅ AI-powered study assistance

Don't pay for expensive prep courses when everything you need is available FREE.