NMLS MLO vs Series 7

NMLS MLO and Series 7 represent different segments of financial services with minimal overlap. MLOs specialize in residential mortgage lending - a real estate transaction. Series 7 representatives specialize in securities - stocks, bonds, options, and funds. While both serve clients making major financial decisions, the products, regulations, and career paths are distinct. Some wealth management professionals hold both to serve high-net-worth clients comprehensively, but this is relatively uncommon since the skills and compliance requirements differ significantly.

Side-by-Side Comparison

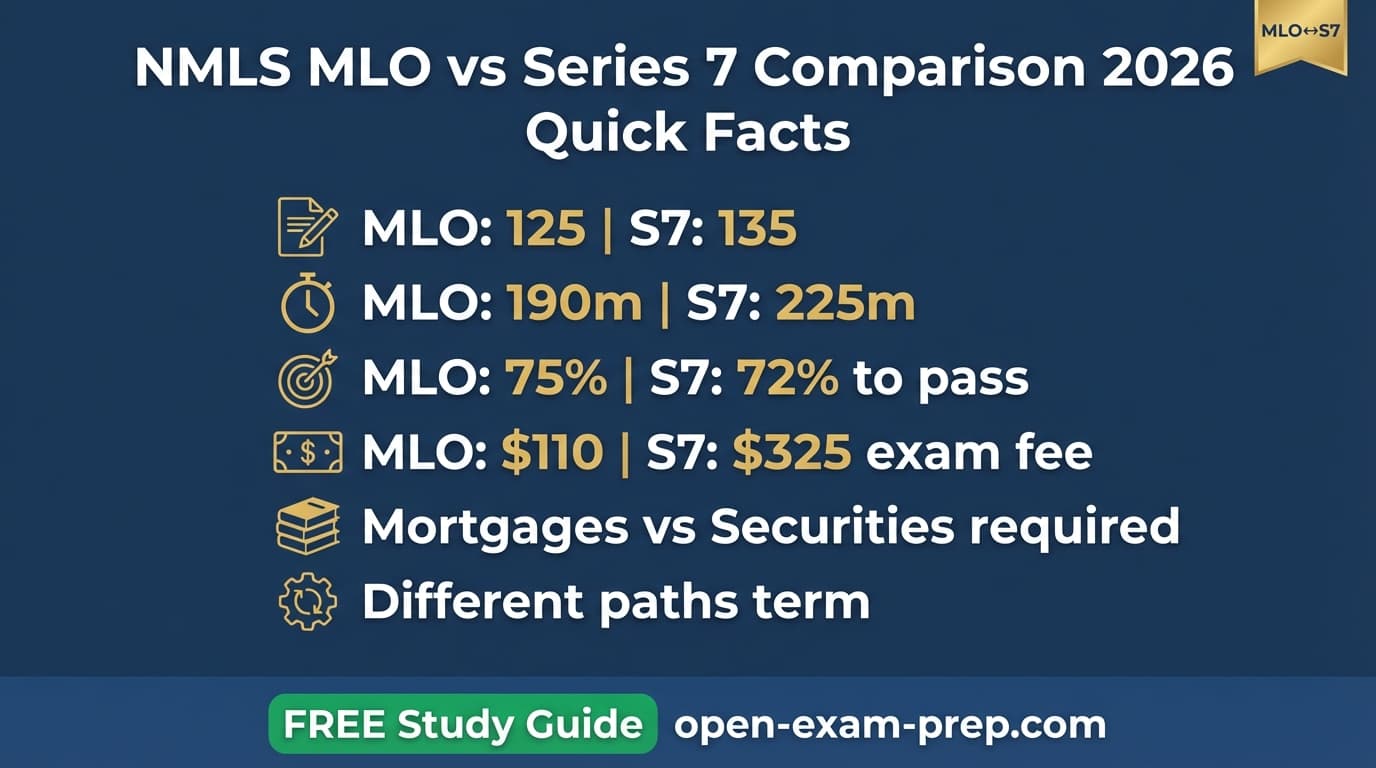

| Feature | NMLS MLO | Series 7 |

|---|---|---|

| Full Name | SAFE Mortgage Loan Originator Test | General Securities Representative |

| Exam Cost | $110 | $245 |

| Passing Score | 75% (86 of 115) | 72% |

| Questions | 125 (115 scored + 10 unscored) | 135 (125 scored + 10 unscored) |

| Time Limit | 190 minutes | 225 minutes |

| Study Time | 40-80 hours | 80-120 hours |

| Difficulty | Moderate | Challenging |

| Prerequisites | 20 hours NMLS-approved pre-licensing education | SIE exam + firm sponsorship |

| Exam Body | NMLS (administered by Prometric) | FINRA |

Key Differences

- 1MLO is mortgage lending; Series 7 is securities trading

- 2MLO regulated by NMLS/CFPB; Series 7 regulated by FINRA/SEC

- 3MLO can be independent; Series 7 requires broker-dealer sponsorship

- 4MLO exam is $110; Series 7 total is $325+ (SIE + Series 7)

- 5MLO commission per loan; Series 7 commission per trade or AUM

- 6Series 7 is significantly harder (125 questions, 80-120 hours study)

What Each Exam Allows You To Do

NMLS MLO

- Originate residential mortgage loans

- Work at banks, mortgage companies, credit unions

- Help homebuyers secure financing

- Earn commission on loan production

Series 7

- Sell all securities (stocks, bonds, options)

- Sell mutual funds and ETFs

- Work as registered representative

- Trade securities for clients

Who Should Take Each Exam?

Take the NMLS MLO if you...

- →Mortgage lending careers

- →Real estate-adjacent professionals

- →Bank lending departments

- →Commission-driven salespeople

Take the Series 7 if you...

- →Full-service broker careers

- →Wirehouse representatives

- →Securities trading roles

- →Those wanting broadest product authority

Which Should You Take First?

These licenses serve different career paths - you'll likely only need one unless building a comprehensive wealth management practice. Choose MLO if your career is in mortgage lending, real estate finance, or bank lending. Choose Series 7 if you want to be a stockbroker, financial advisor, or securities trader. Series 7 is harder and requires sponsorship, but offers broader product authority. MLO is more accessible for independent work.

Frequently Asked Questions

QShould financial advisors have both MLO and Series 7?

It's uncommon but can be valuable for comprehensive wealth management. Advisors serving high-net-worth clients buying expensive homes might benefit from both - managing their investment portfolio (Series 7) and helping with mortgage financing (MLO). However, most advisors refer mortgage business to specialists since maintaining dual compliance is burdensome. The exception is smaller practices where one professional handles all client financial needs.

QWhich is harder - NMLS MLO or Series 7?

Series 7 is significantly harder. The Series 7 has 125 scored questions in 225 minutes covering complex topics like options strategies, margin calculations, and tax implications. Study time is 80-120 hours with a ~70% pass rate. NMLS MLO has 115 scored questions in 190 minutes covering mortgage regulations, with 40-80 hours of study and a 58% pass rate. Both require dedication, but Series 7's content depth and breadth make it the harder exam.

QCan I work at a bank with both licenses?

Yes, large banks employ both MLOs (in mortgage lending departments) and Series 7 representatives (in wealth management/brokerage divisions). However, these are typically separate roles with different compliance requirements. Cross-training in both is unusual because the regulatory burden is significant. Some private bankers serving wealthy clients may hold both to offer comprehensive services, but this requires careful compliance management.

QWhich license has better earning potential?

Both can reach six figures, but the paths differ. Top MLOs earn $100,000-$200,000+ based on loan volume, highly dependent on housing market conditions. Top Series 7 representatives earn similar amounts, but income can be commission (per trade), fee-based (percentage of assets), or salary plus bonus. Series 7 offers more varied compensation structures and potentially more stable income in market downturns since clients need advice regardless of market direction.

10 free AI interactions per day

Ready to Start Studying?

Free study materials for both exams - start learning today.

Related Exam Comparisons

Stay Updated

Get free exam tips and study guides delivered to your inbox.