California Property & Casualty Insurance License Exam Overview

The California Property & Casualty Insurance License Exam is administered by PSI Services on behalf of the California Department of Insurance (CDI). California is the largest insurance market in the nation with unique challenges including wildfires, earthquakes, and strict rate regulation under Proposition 103.

Passing this exam qualifies you to sell property, casualty, and auto insurance in California—serving nearly 40 million residents in the nation's largest state with unparalleled demand for homeowners, auto, and commercial coverage.

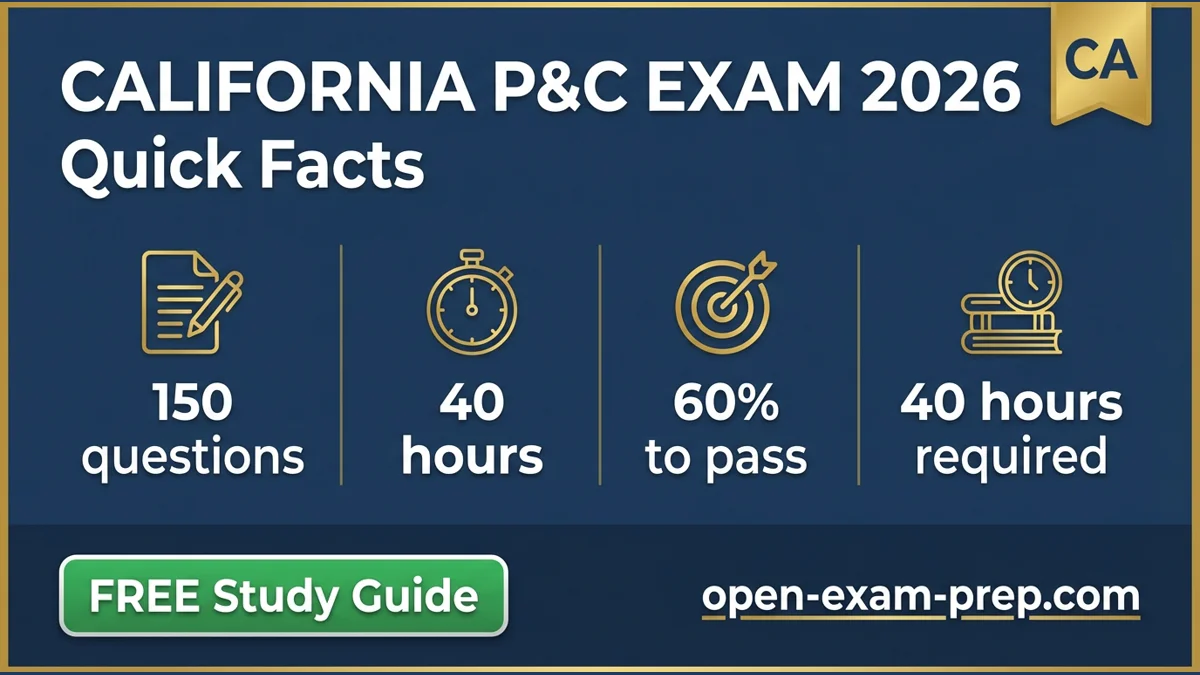

Exam Format at a Glance

| Component | Details |

|---|---|

| Total Questions | 150 multiple-choice |

| Time Limit | 3 hours |

| Passing Score | 60% (90 correct answers) |

| Exam Fee | $92 |

| Pre-licensing Education | 40 hours required |

| Testing Vendor | PSI Services |

| License Term | 2 years |

Why Get P&C Licensed in California?

- Largest state market — Nearly 40 million residents

- High property values — Significant premium volume

- Wildfire coverage needs — Specialty market growing

- Auto insurance required — Every driver needs coverage

- Commercial opportunities — Business insurance demand

📚 Start Your FREE California P&C Exam Prep

Ready to begin studying? Our comprehensive, completely free California P&C exam prep covers everything you need to pass.

Key Topics Covered on the Exam

1. Property Insurance (30%)

Homeowners Insurance:

- HO-2, HO-3, HO-4, HO-5, HO-6, HO-8 forms

- Coverage A through F breakdown

- California-specific endorsements

- Replacement cost vs. actual cash value

California FAIR Plan:

- Fair Access to Insurance Requirements

- Insurer of last resort for fire coverage

- Wildfire-prone area coverage

- Eligibility requirements

- Coverage limits and limitations

California Earthquake Authority (CEA):

- Mini-policy structure

- Deductible options (5%, 10%, 15%, 25%)

- Coverage limitations

- What's covered vs. excluded

- Separate from homeowners policy

Commercial Property:

- Building and personal property coverage

- Business interruption insurance

- Builder's risk coverage

- Inland marine

2. Casualty/Liability Insurance (30%)

Personal Liability:

- Homeowners liability coverage (Coverage E)

- Personal umbrella policies

- Medical payments coverage

Commercial Liability:

- Commercial General Liability (CGL)

- Professional liability (E&O)

- Products and completed operations

- Employment practices liability

Workers' Compensation:

- California mandatory coverage

- State Compensation Insurance Fund (SCIF)

- Employer penalties for non-compliance

- Premium calculation

- Experience modification

3. Auto Insurance (20%)

California Financial Responsibility Law:

| Coverage | Minimum Requirement |

|---|---|

| Bodily Injury (per person) | $15,000 |

| Bodily Injury (per accident) | $30,000 |

| Property Damage | $5,000 |

Additional Auto Topics:

- California Low Cost Auto Insurance Program

- Good Driver Discount (20% mandatory)

- Uninsured/underinsured motorist coverage

- California assigned risk plan

- Proposition 103 rate regulation

4. California Insurance Code (15%)

Key Regulations:

- Proposition 103 (voter-approved rate regulation)

- Prior approval requirements for rates

- Rate rollback provisions

- Good driver discount mandate

CDI Authority:

- California Department of Insurance powers

- Consumer complaint process

- Market conduct examinations

- Enforcement actions

Prohibited Practices:

- Rebating and inducements

- Misrepresentation

- Twisting and churning

- Unfair discrimination

- Unfair claims settlement practices

5. Ethics and General Insurance (5%)

Producer Responsibilities:

- Fiduciary duties

- Premium trust requirements

- Client disclosure obligations

- Surplus lines placement

Continuing Education:

- 24 hours every 2 years

- Includes ethics requirement

- CDI-approved courses only

Study Timeline for Success

| Week | Focus Area | Hours |

|---|---|---|

| Week 1-2 | Property insurance, FAIR Plan, CEA | 14-16 |

| Week 2-3 | Liability insurance and workers' comp | 12-15 |

| Week 3-4 | Auto insurance and CA minimums | 10-12 |

| Week 4-5 | California Insurance Code, Prop 103 | 10-12 |

| Week 5-6 | Practice exams and review | 12-15 |

Total recommended study time: 58-70 hours (plus 40-hour pre-licensing)

🎯 Free Practice Questions Available

Test your knowledge with hundreds of free practice questions designed specifically for the California P&C exam.

California-Specific Exam Tips

1. Master the FAIR Plan

California's FAIR Plan is essential:

- Insurer of last resort for fire coverage

- Critical for wildfire-prone areas

- Know eligibility requirements

- Understand coverage limitations vs. standard policies

2. Understand California Earthquake Authority (CEA)

Earthquake coverage is unique to California:

- Not included in standard homeowners

- Mini-policy with limited coverage

- High deductibles (5-25%)

- Know what's covered and excluded

3. Know Proposition 103

California's unique rate regulation:

- Prior approval required for rate changes

- Good driver discount mandatory (20%)

- Rate rollback provisions

- Consumer Watchdog oversight

4. Key Numbers to Remember

| Topic | California Requirement |

|---|---|

| Passing score | 60% (90/150) |

| Pre-licensing | 40 hours |

| License term | 2 years |

| CE requirement | 24 hours/2 years |

| Auto BI minimums | 15/30 |

| Auto PD minimum | $5,000 |

| Good driver discount | 20% mandatory |

Common Mistakes to Avoid

- Ignoring FAIR Plan details — Major exam topic

- Forgetting CEA structure — Unique to California

- Missing Proposition 103 — Heavily tested

- Underestimating 15/30/5 — Among lowest minimums

- Skipping workers' comp — Mandatory in California

- Not practicing enough — 150 questions needs preparation

After Passing Your Exam

- Submit license application to CDI

- Pay license fee ($188 for 2 years)

- Complete fingerprinting ($49)

- Obtain appointment from insurance carrier

- Maintain CE requirements (24 hours/2 years)

- Begin your insurance career in California

2026 California Updates

For 2026, be aware of:

- Wildfire insurance market changes

- FAIR Plan coverage updates

- Proposition 103 developments

- Climate risk disclosure requirements

Start Your California P&C Career Today

The California Property & Casualty license opens doors to serving the nation's largest insurance market with unique challenges and opportunities. With proper preparation, you can pass the exam on your first attempt.

Our free study materials include:

- ✅ Complete topic coverage

- ✅ Practice questions with explanations

- ✅ FAIR Plan and CEA specifics

- ✅ Proposition 103 coverage

- ✅ AI-powered study assistance

Don't pay for expensive prep courses when everything you need is available FREE.