Montana Property & Casualty Insurance License Exam Overview

The Montana Property & Casualty Insurance License Exam is administered by Pearson VUE on behalf of the Montana Commissioner of Securities and Insurance (CSI). Montana's vast rural landscape, harsh winters, and growing wildfire risk create unique insurance challenges that require specialized P&C knowledge.

Passing this exam qualifies you to sell property insurance, auto insurance, liability coverage, and related products throughout Montana—a state with over 1 million residents spread across the fourth-largest state by area, where weather extremes and wildfire exposure drive significant P&C insurance needs.

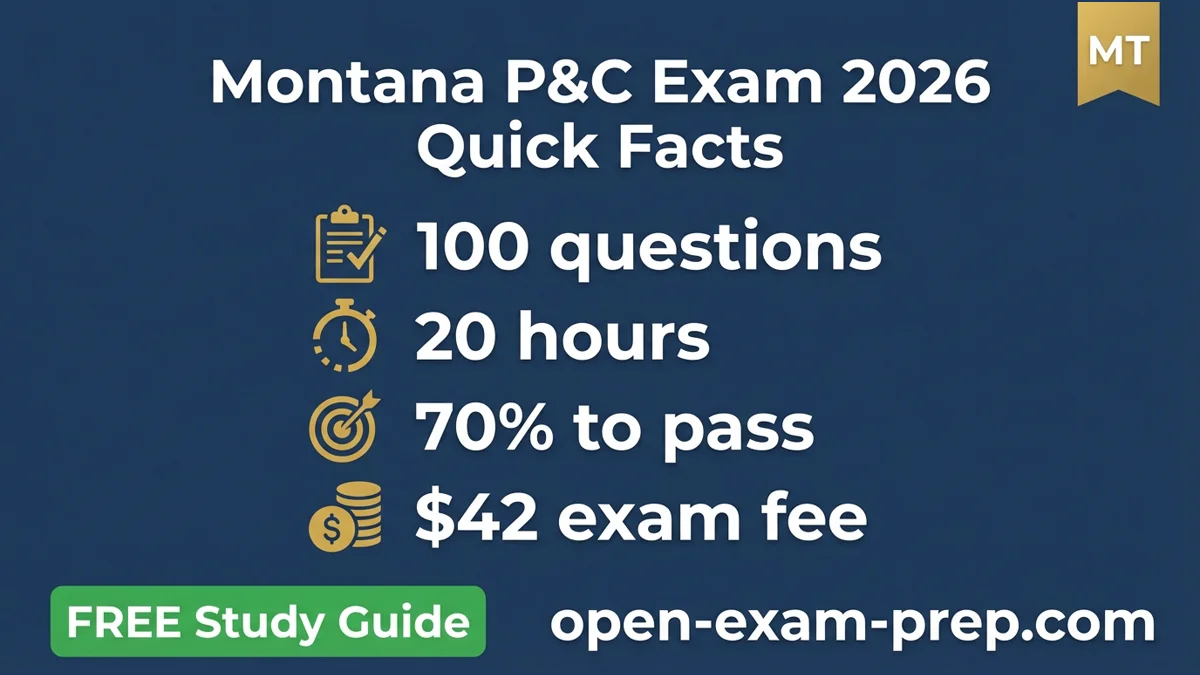

Exam Format at a Glance

| Component | Details |

|---|---|

| Total Questions | 100 multiple-choice |

| Scored Questions | 100 |

| Time Limit | 2 hours |

| Passing Score | 75% (75 correct answers) |

| Testing Vendor | Pearson VUE |

| Exam Fee | $59 |

| Pre-licensing Education | Not required (recommended) |

Why Get P&C Licensed in Montana?

- Growing wildfire market — Increasing demand for specialized coverage

- Rural expertise valued — Unique agricultural and ranching needs

- Low competition — Fewer agents per capita than many states

- Affordable entry — Only 20 hours pre-licensing required

- Quality of life — Beautiful state with strong insurance demand

Start Your FREE Montana P&C Exam Prep

Ready to begin studying? Our comprehensive, completely free Montana P&C exam prep covers everything you need to pass.

Key Topics Covered on the Exam

1. Property Insurance (30%)

Homeowners Insurance:

- HO-2, HO-3, HO-4, HO-5, HO-6, HO-8 policy forms

- Coverage A (Dwelling), B (Other Structures), C (Personal Property)

- Coverage D (Loss of Use), E (Personal Liability)

- Dwelling fire policies

Montana-Specific Property Topics:

- Montana FAIR Plan (residual market)

- Wildfire coverage and defensible space requirements

- Severe winter weather coverage (snow load, ice dams)

- Hail coverage (eastern Montana exposure)

- Farm and ranch property insurance

Commercial Property:

- Building and personal property coverage forms

- Business income coverage

- Equipment breakdown

- Inland marine coverage

2. Liability Insurance (30%)

Personal Liability:

- Homeowners liability (Coverage E)

- Personal umbrella policies

- Medical payments coverage

Commercial Liability:

- Commercial General Liability (CGL)

- Products and completed operations

- Professional liability (E&O)

- Workers' compensation requirements

Montana Workers' Compensation:

- Required for all employers (with limited exceptions)

- Montana State Fund (competitive state fund)

- Private carrier options available

- Self-insurance options for qualified employers

3. Auto Insurance (25%)

Montana Auto Insurance Requirements:

| Coverage | Minimum Limit |

|---|---|

| Bodily Injury (per person) | $25,000 |

| Bodily Injury (per accident) | $50,000 |

| Property Damage | $20,000 |

Additional Auto Topics:

- Personal Auto Policy (PAP) coverage parts

- Montana financial responsibility law

- Uninsured motorist coverage (optional in MT)

- Underinsured motorist coverage

- SR-22 requirements

- Commercial auto insurance

4. Montana Insurance Code and Regulations (10%)

Title 33 Key Provisions:

- Producer licensing requirements

- Unfair trade practices

- Unfair claims settlement practices

- Policy cancellation and nonrenewal rules

- Advertising guidelines

Licensing Requirements:

- Pre-licensing education: 20 hours (lower than most states)

- Continuing education: 24 hours every 2 years

- Ethics requirement: 3 hours included in CE

- Background check required

5. Ethics and Professional Conduct (5%)

- Fiduciary duties to insureds

- Premium handling requirements

- Claims reporting obligations

- Privacy and confidentiality

Study Timeline for Success

| Week | Focus Area | Hours |

|---|---|---|

| Week 1 | Property insurance fundamentals | 10-12 |

| Week 2 | Liability insurance | 10-12 |

| Week 3 | Auto insurance and MT requirements | 10-12 |

| Week 4 | Montana regulations (Title 33) | 8-10 |

| Week 4-5 | Practice exams and review | 10-12 |

Total recommended study time: 45-55 hours

Free Practice Questions Available

Test your knowledge with hundreds of free practice questions designed specifically for the Montana P&C exam.

Montana-Specific Exam Tips

1. Know Montana Auto Minimums

Montana requires 25/50/20 liability coverage:

- $25,000 per person bodily injury

- $50,000 per accident bodily injury

- $20,000 property damage

2. Master Wildfire Coverage

Montana's growing wildfire risk is critical:

- Defensible space — Brush clearing requirements for coverage

- Wildfire mitigation discounts — Available from many carriers

- Evacuation coverage — Additional living expense considerations

- Replacement cost issues — Remote location rebuilding costs

3. Understand Rural and Agricultural Coverage

Montana's rural character requires specialized knowledge:

- Farm and ranch policies — Combined property and liability

- Livestock coverage — Mortality and theft protection

- Equipment coverage — Farm machinery and implements

- Outbuilding coverage — Barns, silos, and storage structures

4. Key Numbers to Remember

| Topic | Montana Requirement |

|---|---|

| Auto minimums | 25/50/20 |

| WC threshold | All employers |

| Pre-licensing | 20 hours |

| CE requirement | 24 hours/2 years |

| Passing score | 70% |

Common Mistakes to Avoid

- Ignoring wildfire coverage — Growing concern across Montana

- Not knowing auto minimums — Montana is 25/50/20

- Skipping rural/agricultural — Major market segment in MT

- Underestimating winter weather — Snow load and ice coverage

- Not practicing timed exams — 2 hours for 100 questions

- Cramming last minute — Spread study over 4-5 weeks

After Passing Your Exam

- Apply for license through Montana Commissioner of Securities and Insurance

- Complete background check — Required for all applicants

- Pay license fee — Resident license fee applies

- Affiliate with insurer — Get appointed by carrier

- Maintain CE compliance — 24 hours every 2 years

- Begin selling — Your license is valid for 2 years

2026 Montana Updates

For 2026, be aware of:

- Wildfire coverage rate changes and availability

- Winter weather coverage updates

- Agricultural insurance modifications

- Enhanced consumer protection regulations

Start Your Montana P&C Insurance Career Today

The Montana P&C license opens doors to a unique market where rural expertise and wildfire knowledge are highly valued. With proper preparation, you can pass the exam on your first attempt.

Our free study materials include:

- Complete topic coverage

- Practice questions with explanations

- Montana-specific regulations (Title 33)

- Study guides and summaries

- AI-powered study assistance

Don't pay for expensive prep courses when everything you need is available FREE.