Why Property & Casualty Insurance Is a Great Career Path

Property and casualty (P&C) insurance is one of the largest segments of the insurance industry, covering everything from auto and home insurance to commercial property and liability. With a P&C license, you can sell the insurance products people need most.

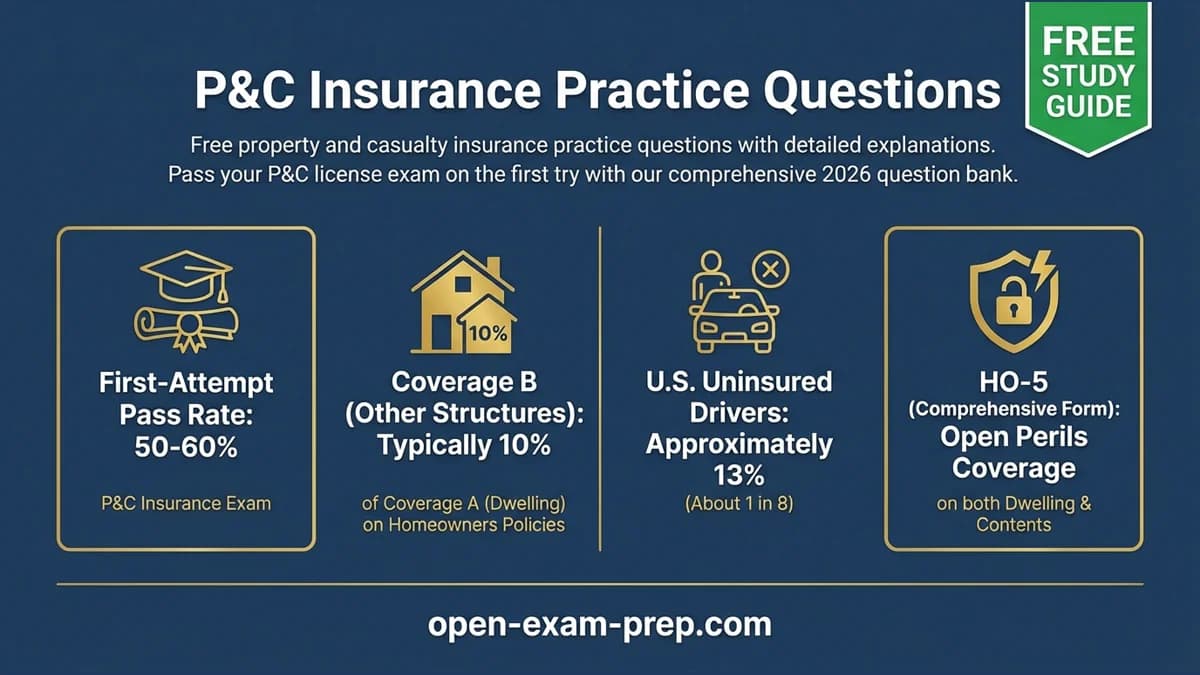

The P&C exam has a pass rate of about 50-60%, making solid preparation essential for first-time success.

P&C Exam Format (2026)

| Component | Details |

|---|---|

| Total Questions | 150 questions (most states) |

| Time Limit | 2-3 hours |

| Passing Score | 70% (most states) |

| Topics | Property, auto, liability, commercial, regulations |

| Format | Multiple choice, computer-based |

Sample Practice Questions by Topic

Property Insurance (25%)

Question 1: Coverage B (Other Structures) on a dwelling policy typically provides what percentage of Coverage A?

A) 5% B) 10% C) 20% D) 50%

Answer: B - Coverage B for other structures is typically 10% of Coverage A. For a $300,000 dwelling, Coverage B would automatically be $30,000. This covers detached garages, sheds, and fences.

Question 2: Which homeowners policy form provides "open perils" coverage on both the dwelling and personal property?

A) HO-2 (Broad Form) B) HO-3 (Special Form) C) HO-5 (Comprehensive Form) D) HO-4 (Renters)

Answer: C - HO-5 provides open perils (all-risk) coverage on both the dwelling and personal property. HO-3 provides open perils on the dwelling but named perils on contents.

Question 3: A homeowner's personal property is typically covered for what percentage of Coverage A?

A) 25% B) 50% C) 75% D) 100%

Answer: B - Coverage C (Personal Property) is typically 50% of Coverage A. For a $400,000 dwelling, personal property coverage would be $200,000.

Question 4: Which of the following is NOT covered under a standard homeowners policy?

A) Fire damage B) Theft C) Flood damage D) Windstorm damage

Answer: C - Flood damage is excluded from standard homeowners policies and requires separate flood insurance through NFIP or private insurers.

Question 5: The vacancy provision in a dwelling policy typically applies after how many consecutive days?

A) 30 days B) 60 days C) 90 days D) 120 days

Answer: B - Most policies reduce or eliminate coverage for vandalism and certain other perils after a property is vacant for more than 60 consecutive days.

Auto Insurance (25%)

Question 6: Approximately what percentage of drivers in the U.S. are uninsured?

A) 5% B) 13% C) 25% D) 35%

Answer: B - Approximately 13% of drivers nationally are uninsured (about 1 in 8). This rate varies by state from 6% (Massachusetts) to 29% (Mississippi).

Question 7: Under the Personal Auto Policy, which coverage pays for damage when your vehicle hits a deer?

A) Collision B) Comprehensive (Other Than Collision) C) Liability D) Uninsured motorist

Answer: B - Hitting an animal is covered under Comprehensive (Other Than Collision). Collision covers damage from hitting another vehicle or object.

Question 8: Medical Payments coverage under an auto policy:

A) Only covers the named insured B) Pays regardless of fault C) Requires a deductible D) Covers only hospital bills

Answer: B - Medical Payments coverage pays regardless of fault for medical expenses of the insured and passengers. It's a first-party coverage with no deductible.

Question 9: In a no-fault auto insurance state, an injured person:

A) Must prove the other driver was negligent B) Collects from their own insurer regardless of fault C) Cannot sue for any damages D) Must have collision coverage

Answer: B - In no-fault states, injured parties collect from their own insurer for economic losses (medical bills, lost wages) regardless of who caused the accident.

Question 10: Uninsured Motorist coverage protects you when:

A) You hit an uninsured driver B) An uninsured driver injures you C) You drive without insurance D) Your vehicle is stolen

Answer: B - UM coverage protects you when an uninsured driver causes you injury. It essentially steps into the shoes of the at-fault driver's missing liability coverage.

Liability Insurance (20%)

Question 11: In a pure contributory negligence state, if a plaintiff is 5% at fault for their $100,000 in damages, they will recover:

A) $100,000 B) $95,000 C) $50,000 D) $0

Answer: D - In pure contributory negligence states (4 states + DC), if the plaintiff is even 1% at fault, they recover nothing. This harsh rule completely bars recovery.

Question 12: Which of the following is an example of vicarious liability?

A) A person is liable for their own negligent acts B) An employer is liable for employee actions during work C) A product manufacturer is liable for defects D) A property owner is liable for attractive nuisances

Answer: B - Vicarious liability (respondeat superior) holds employers liable for employee actions within the scope of employment.

Question 13: A CGL policy covers which of the following?

A) Professional errors and omissions B) Employee injuries C) Third-party bodily injury and property damage D) Auto accidents

Answer: C - Commercial General Liability covers third-party bodily injury and property damage arising from operations. It excludes professional liability, workers comp, and auto.

Question 14: An "occurrence" policy covers claims:

A) Made during the policy period B) Arising from incidents during the policy period C) Reported within 60 days D) Filed in court during the policy period

Answer: B - Occurrence policies cover incidents that occur during the policy period, regardless of when the claim is made. Claims-made policies cover claims made during the policy period.

Commercial Insurance (15%)

Question 15: A Business Owners Policy (BOP) is designed for:

A) Large corporations B) Small to medium-sized businesses C) Sole proprietors only D) Retail stores only

Answer: B - A BOP is a package policy designed for small to medium-sized businesses, combining property and liability coverage at a lower cost than separate policies.

Question 16: Workers compensation insurance:

A) Is optional in all states B) Covers employees regardless of fault C) Only covers injuries at the workplace D) Is provided by the employer directly

Answer: B - Workers comp provides no-fault coverage for employees injured in the course of employment, regardless of who caused the injury.

Question 17: Which endorsement adds coverage for equipment breakdown?

A) Ordinance or law B) Equipment breakdown coverage C) Business income D) Valuable papers

Answer: B - Equipment breakdown coverage (formerly boiler and machinery) covers damage from mechanical breakdown, electrical failure, and similar equipment failures.

Regulations & Claims (15%)

Question 18: The difference between license suspension and revocation is:

A) They are the same penalty B) Suspension is temporary; revocation is permanent C) Revocation is temporary; suspension is permanent D) Suspension requires a hearing; revocation does not

Answer: B - Suspension is temporary removal of license privileges for a fixed period. Revocation is permanent termination requiring reapplication after a waiting period.

Question 19: The typical maximum fine per violation of insurance laws is:

A) $100 B) $1,000 C) $10,000 D) $100,000

Answer: C - The typical maximum fine is $10,000 per violation. Continued violations can be treated as separate offenses, with each day counting as a new violation.

Question 20: After a covered loss, the insured's first duty is to:

A) File a lawsuit B) Protect the property from further damage C) Contact their attorney D) Get three repair estimates

Answer: B - The insured must protect property from further damage (mitigate losses). This is a policy condition; failure to do so can reduce the claim payment.

Key Formulas to Know

| Calculation | Formula |

|---|---|

| Coinsurance Penalty | (Amount Carried ÷ Amount Required) × Loss |

| ACV | Replacement Cost - Depreciation |

| Pure Premium | Losses ÷ Exposure Units |

| Loss Ratio | Incurred Losses ÷ Earned Premium |

Study Tips for the P&C Exam

- Know policy forms - HO-2, HO-3, HO-5 and their differences

- Master auto coverages - liability, collision, comprehensive, UM/UIM

- Understand negligence - contributory vs. comparative

- Learn commercial basics - BOP, CGL, workers comp

- Study claims procedures - duties after loss, proof of loss

Start Your Free Practice

Our free P&C insurance practice question bank includes 180+ questions covering all exam topics with detailed explanations.

Ready to Pass Your P&C Exam?

| Resource | Description |

|---|---|

| Free Practice Questions → | 180+ exam-style questions with detailed explanations |

| Complete Study Guide → | Full exam content covering property, auto, liability, and commercial |

| Insurance Category → | All insurance exam resources in one place |

Start with our free practice questions, then master the content with our comprehensive study guide. With thorough preparation, you can pass your P&C license exam on the first try!