CFP Certification Exam Overview

The Certified Financial Planner (CFP) certification is administered by the CFP Board and is the most recognized credential for financial planners in the United States. The CFP designation demonstrates competence and commitment to ethical financial planning.

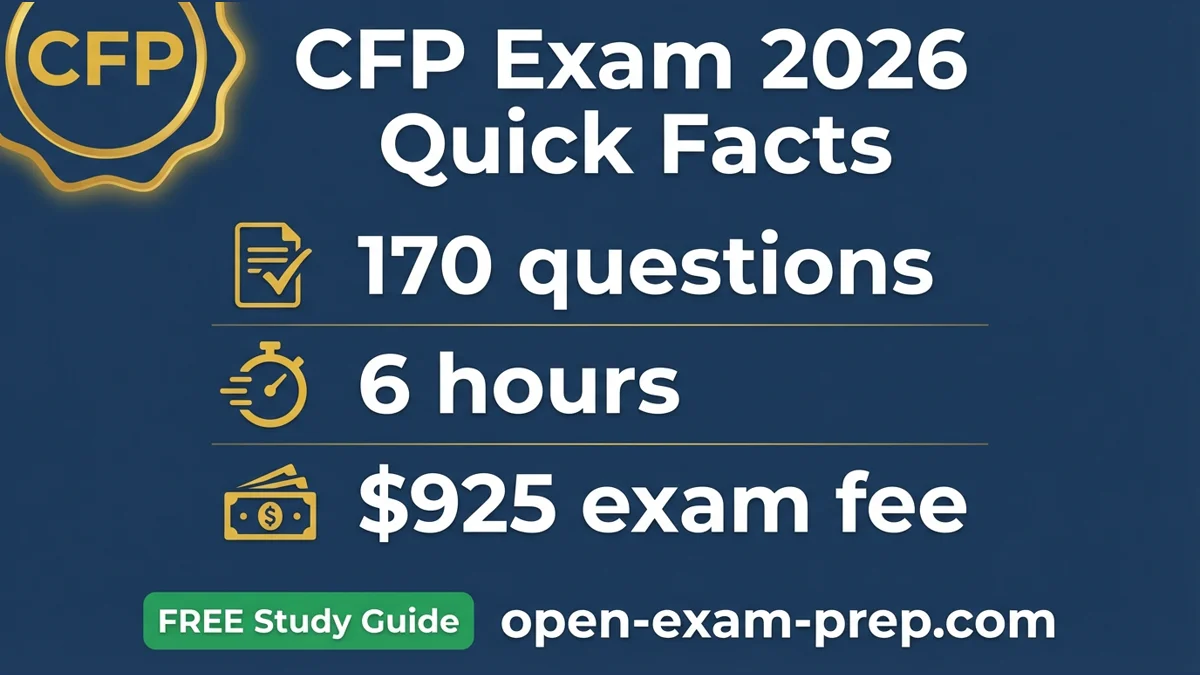

Exam Format

| Component | Details |

|---|---|

| Questions | 170 multiple-choice questions |

| Time Limit | 6 hours (two 3-hour sessions) |

| Passing Score | ~65% (scaled scoring) |

| Exam Fee | $925 |

| Eligibility | Education, experience, ethics requirements |

| Validity | 2 years (30 CE hours annually) |

Start FREE CFP Exam Prep

8 Principal Knowledge Domains

The CFP exam covers eight principal knowledge domains essential for comprehensive financial planning:

1. Professional Conduct and Regulation (8%)

- CFP Board Code of Ethics and Standards

- Fiduciary duty and duty of care

- Regulatory requirements (SEC, FINRA, state)

- Practice standards and disciplinary process

2. General Financial Planning Principles (15%)

- Financial planning process

- Time value of money calculations

- Economic concepts and analysis

- Client communication and counseling

- Behavioral finance considerations

3. Risk Management and Insurance Planning (11%)

- Life insurance analysis and planning

- Health insurance and long-term care

- Disability income insurance

- Property and casualty insurance

- Liability insurance

4. Investment Planning (17%)

- Investment theory and portfolio management

- Asset allocation and diversification

- Securities analysis (stocks, bonds, alternatives)

- Investment strategies and tax considerations

- Performance measurement

5. Tax Planning (14%)

- Income tax fundamentals

- Tax planning strategies

- Business entities and taxation

- Tax implications of investment decisions

- Estate and gift tax basics

6. Retirement Savings and Income Planning (18%)

- Qualified retirement plans (401(k), 403(b), pension)

- IRAs and Roth accounts

- Social Security optimization

- Distribution planning and strategies

- Medicare and retirement healthcare

7. Estate Planning (10%)

- Estate planning documents (wills, trusts)

- Transfer techniques and strategies

- Estate and gift tax planning

- Business succession planning

- Charitable planning

8. Psychology of Financial Planning (7%)

- Client and planner attitudes toward money

- Behavioral finance principles

- Counseling and communication techniques

- Client-planner relationships

Free Practice Questions

CFP Eligibility Requirements

Education Requirement

- Bachelor's degree (or higher) from an accredited institution

- Completion of CFP Board-registered education program covering all principal knowledge topics

Experience Requirement

Choose one of two pathways:

- Standard Pathway: 6,000 hours of professional experience

- Apprenticeship Pathway: 4,000 hours under CFP professional supervision

Ethics Requirement

- Complete ethics declaration

- Background check

- Agree to CFP Board's Code of Ethics and Standards of Conduct

Study Timeline

| Week | Focus | Hours |

|---|---|---|

| Week 1-2 | General Principles + Professional Conduct | 25-30 |

| Week 3-4 | Risk Management + Insurance Planning | 20-25 |

| Week 5-7 | Investment Planning (largest weight) | 35-40 |

| Week 8-9 | Tax Planning | 25-30 |

| Week 10-12 | Retirement Planning (largest weight) | 35-40 |

| Week 13-14 | Estate Planning | 20-25 |

| Week 15 | Psychology + Integration | 15-20 |

| Week 16-18 | Practice Exams + Review | 40-50 |

Total: 200-260 hours recommended

Key Exam Topics for 2026

Case Study Integration

The CFP exam emphasizes practical application through case studies:

- Multi-topic integration questions

- Client scenario analysis

- Comprehensive financial planning

- Trade-off decisions

Calculations to Master

- Time value of money (PV, FV, PMT, I/Y, N)

- Net present value and internal rate of return

- Tax liability calculations

- Retirement income needs analysis

- Insurance needs analysis

- Estate tax calculations

Tax Law Updates for 2026

- Current contribution limits for retirement accounts

- Estate and gift tax exemptions

- Standard deduction amounts

- Capital gains tax brackets

Tips for Success

- Master the CFP Board's Standards of Conduct - Ethics questions appear throughout

- Focus on Integration - Questions often span multiple knowledge domains

- Practice Case Studies - Real exam mirrors comprehensive planning scenarios

- Know Your Calculations - Time value of money is foundational

- Understand "Why" - Rationale matters more than memorization

- Use Process of Elimination - CFP questions often have close answer choices

Exam Day Information

Two Testing Sessions

- Session 1: 3 hours (morning)

- Break: 40 minutes (scheduled)

- Session 2: 3 hours (afternoon)

Testing Centers

- Prometric testing centers nationwide

- Computer-based testing

- Provide two forms of valid ID

What to Bring

- Valid government-issued ID

- Confirmation email from Prometric

- CFP Board-approved calculator only

Pass Rates and Statistics

| Metric | 2024-2025 Data |

|---|---|

| First-Time Pass Rate | ~60% |

| Overall Pass Rate | ~65% |

| Active CFP Professionals | 100,000+ |

| Exam Offered | 3 testing windows per year |

Start Your CFP Journey Today

Everything you need to pass is 100% FREE.