The Problem: Clients Keep Asking About Day Trading

You're a financial advisor. Your client walks in and says:

"My coworker just quit his job to day trade full-time. He says he's making $500 a day. I want to try it too—what do you think?"

What do you say?

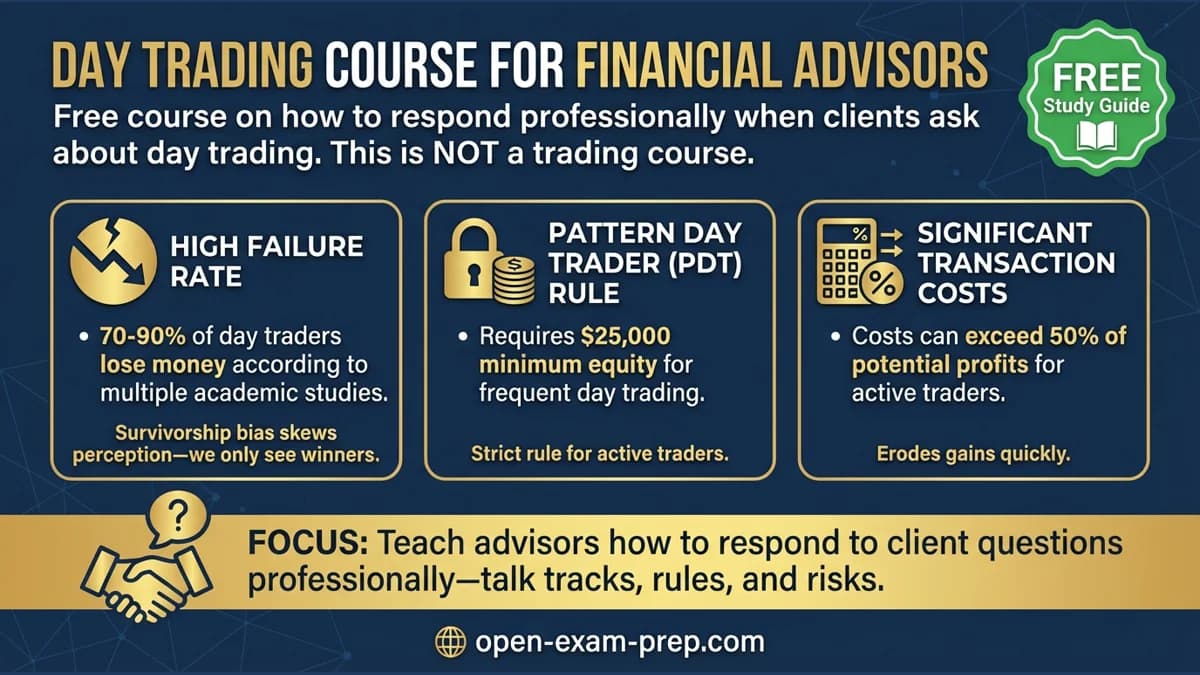

This course teaches you how to respond professionally without recommending or discouraging day trading. Because here's the reality: you can't just say "that's a bad idea"—but you also can't pretend the risks don't exist.

This is not a trading course. Start the free course →

What This Course Is (And Isn't)

✅ What This Course IS:

- Professional orientation for client conversations

- Understanding why most day traders lose money

- Talk-tracks and response frameworks

- Regulatory context (PDT rule, FINRA guidance)

- How to educate without recommending

❌ What This Course is NOT:

- A trading course or strategy guide

- Investment advice or recommendations

- Teaching you how to make money trading

- For people looking to start day trading

We don't teach people how to trade. We teach financial professionals how to respond to what their clients are doing.

Why You Need This Training

The Client Questions Keep Coming

Day trading curiosity spikes during:

- Bull markets (everyone thinks they can pick winners)

- After clients hear success stories from friends

- When meme stocks or crypto go viral

- After market volatility makes headlines

If you can't answer intelligently, you lose credibility. If you answer wrong, you risk compliance issues.

The Compliance Tightrope

You need to:

- Acknowledge their interest (not dismiss it)

- Educate without recommending

- Discuss risks without being preachy

- Stay compliant with FINRA guidelines

This course gives you the framework.

The Reality: Why 90% of Day Traders Lose Money

When clients ask about day trading, they need to understand these facts:

1. Transaction Costs Add Up

| Trade Size | Commission | Spread Cost | Total per Trade |

|---|---|---|---|

| $10,000 | $0-10 | $10-50 | $10-60 |

| 5 trades/day | × 5 | × 5 | $50-300/day |

| 250 trading days | × 250 | × 250 | $12,500-75,000/year |

To break even on a $100,000 account trading 5 times daily, you need to generate $12,500-75,000 just to cover costs. Before you make a dollar of profit.

2. You're Trading Against Professionals

Day traders compete against:

- Market makers with better data and faster systems

- Algorithmic trading firms with PhD-level quantitative models

- Institutional traders with inside knowledge of order flow

It's like a poker game where some players can see everyone's cards.

3. Behavioral Traps

| Trap | What Happens | Result |

|---|---|---|

| Revenge trading | Losing trade → trade more to recover | Bigger losses |

| Overconfidence | Three wins → "I figured this out" | Oversize next bet, wipe out gains |

| Loss aversion | Hold losers, sell winners | Portfolio of losers |

| Gambler's fallacy | "I'm due for a win" | Ignore probability |

4. Tax Inefficiency

Day trading profits are taxed as short-term capital gains (ordinary income rates up to 37% federal + state). Long-term investing profits are taxed at 15-20%.

A day trader earning $100,000 might pay $15,000-20,000 more in taxes than an investor with the same gains.

5. Survivorship Bias

Clients hear about day trading success stories because:

- Winners post on social media

- Losers don't advertise their failures

- "Quit my job to day trade" is a story

- "Lost my savings day trading" isn't shared

The 10% who succeed are visible. The 90% who fail are silent.

The PDT Rule: What Clients Need to Know

Pattern Day Trader Rule Basics

| Requirement | Detail |

|---|---|

| Trigger | 4+ day trades in 5 business days |

| Minimum equity | $25,000 in margin account |

| What counts | Buy AND sell same security same day |

| Consequence of violation | Account frozen for 90 days |

Why the Rule Exists

FINRA implemented this after the dot-com bubble when inexperienced traders were:

- Using maximum leverage (4:1 buying power)

- Making dozens of trades daily

- Losing their life savings rapidly

The $25,000 minimum was designed to ensure traders could absorb losses.

Common Client Questions

"Why is there a $25,000 minimum?"

"The rule was created after many people lost everything during the dot-com bubble. FINRA set this threshold to ensure people trading frequently have enough capital to handle volatility without being wiped out."

"Can I get around it?"

"There are workarounds—cash accounts (no margin, T+1 settlement), multiple brokerages, or trading options. But the rule exists for a reason. If you're trying to avoid a safety rule, that's worth thinking about."

Professional Response Framework

The 4-Step Response

When clients ask about day trading:

Step 1: Acknowledge without validating

"I can see why that's interesting—it's exciting to think about active trading."

Step 2: Ask clarifying questions

"Help me understand—what's attracting you to this? Is it the potential returns, the action, or something else?"

Step 3: Provide factual information

"Here's what the research shows about day trading outcomes..." [share statistics]

Step 4: Redirect to goals

"How does this fit with the goals we've been working toward? Would it change your timeline for [retirement/house/etc.]?"

Sample Conversations

Client says: "My coworker quit his job to day trade and says he's making $500/day."

Weak response: "That's a bad idea. Most day traders lose money."

Strong response: "That's an interesting situation. A few questions: Do you know how long he's been doing it? What's his track record over a full year, not just good days? The research shows 70-90% of day traders lose money overall—but the success stories are what we hear about because no one posts their losses on social media."

Client says: "Why is there a $25,000 minimum? That seems unfair."

Weak response: "Those are the FINRA rules."

Strong response: "Good question. After the dot-com crash, a lot of people lost everything trading with high leverage. FINRA set the $25K minimum so people trading frequently have enough cushion to survive volatility. Think of it as a safety barrier—if you're trying to get around a safety rule, that's worth asking yourself why."

Client says: "If day trading is so risky, why is it legal?"

Weak response: "I don't know, it probably shouldn't be."

Strong response: "That's a thoughtful question. Lots of risky activities are legal—skydiving, riding motorcycles, opening a restaurant. The question isn't whether something is legal, but whether it's right for you given your goals and risk tolerance. For most people, day trading doesn't improve their financial outcomes—but some people have the capital, time, and temperament to treat it as a hobby they can afford to lose on."

Topics Covered in the Free Course

| Module | What You'll Learn |

|---|---|

| Market Microstructure | How markets work, liquidity, spreads, market makers |

| Economics of Day Trading | Transaction costs, who profits, why most lose |

| Common Strategy Types | Momentum, mean reversion, news trading (described, not recommended) |

| Failure Modes | Psychology, costs, taxes, behavioral traps |

| Regulatory Framework | PDT rule, margin, T+1 settlement, FINRA guidance |

| Professional Response | Talk-tracks, scripts, what to say and not say |

Why This Course is Unique

There are thousands of day trading courses. This is the only free course designed for advisors who need to RESPOND to day trading questions—not learn to trade.

What You Won't Find Elsewhere

- ✅ Talk tracks for client conversations

- ✅ Compliance-aware response frameworks

- ✅ How to educate without recommending

- ✅ The advisor perspective (not trader perspective)

Who Takes This Course

- New financial advisors getting client questions

- Series 7/65/66 candidates

- Experienced advisors wanting better responses

- Compliance officers developing training materials

Start the Free Course

This course includes:

- 5 comprehensive modules on day trading fundamentals

- Professional talk-tracks for common questions

- Roleplay scenarios to practice responses

- Regulatory context for compliance awareness

- Free AI tutor for deeper questions

Start Free Day Trading Course →

Key Takeaways

- 70-90% of day traders lose money—this is well-documented

- Transaction costs alone can require $12,500-75,000/year just to break even

- The PDT rule requires $25,000 minimum for frequent trading

- Survivorship bias makes winners visible and losers invisible

- Advisors need to educate, not recommend—this course teaches how

We don't teach people how to trade. We teach financial professionals how to respond to what their clients are doing.