Enrolled Agent (EA) Exam Overview

The Enrolled Agent (EA) credential is the highest IRS-awarded designation for tax professionals. Enrolled Agents have unlimited rights to represent taxpayers before the IRS on any tax matter. The EA exam, officially called the Special Enrollment Examination (SEE), is administered by Prometric on behalf of the IRS.

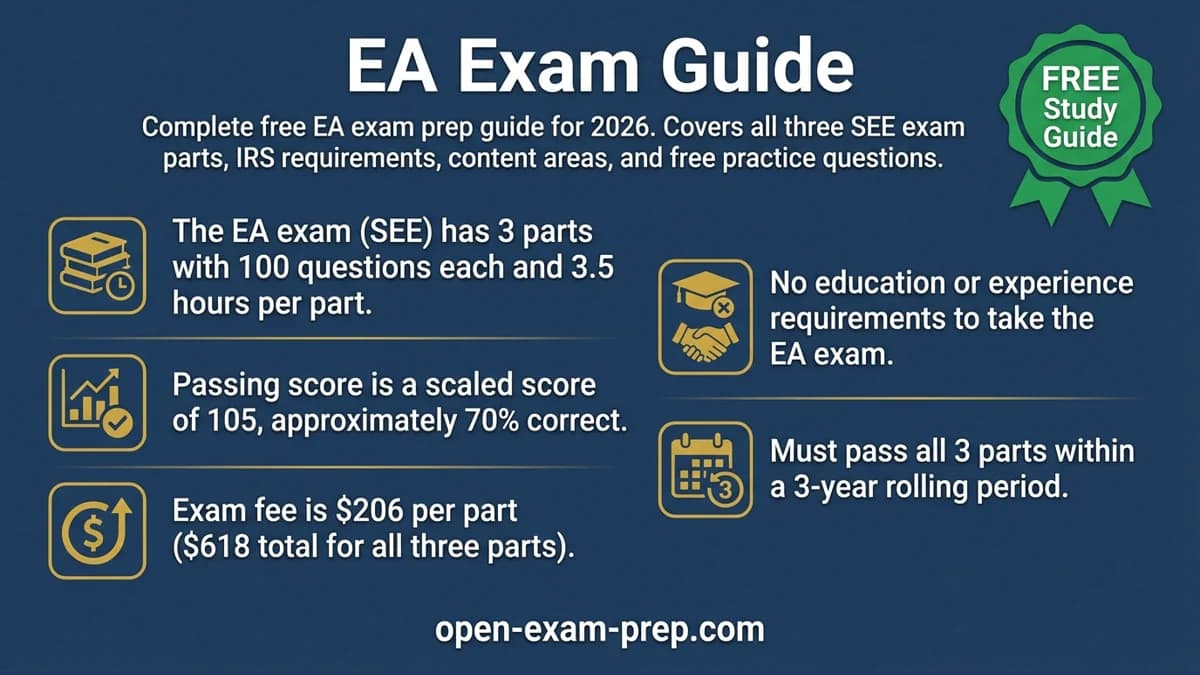

Exam Format

| Component | Details |

|---|---|

| Total Parts | 3 separate exams |

| Questions per Part | 100 questions each |

| Time Limit | 3.5 hours per part |

| Passing Score | Scaled score of 105 (~70%) |

| Exam Fee | $206 per part ($618 total) |

| Testing Centers | Prometric nationwide |

| Eligibility | No education requirements |

| Validity | Must pass all 3 parts within 3 years |

Start FREE EA Exam Prep

The Three Exam Parts

The SEE consists of three separate examinations, each covering distinct tax topics:

Part 1: Individuals (100 Questions)

Part 1 focuses on individual income tax returns (Form 1040):

- Filing Status & Exemptions - Single, MFJ, MFS, HOH, qualifying widower

- Gross Income - Wages, interest, dividends, capital gains, retirement distributions

- Adjustments to Income - IRA contributions, student loan interest, HSA contributions

- Itemized Deductions - Medical, taxes, interest, charitable contributions, casualty losses

- Tax Credits - Child tax credit, EITC, education credits, dependent care credit

- Alternative Minimum Tax (AMT) - Calculation and preference items

- Self-Employment Tax - Schedule C and Schedule SE

- Basis of Assets - Cost basis, adjustments, inherited and gifted property

- Capital Gains and Losses - Short-term vs long-term, netting rules

- Retirement Plans - IRAs, Roth IRAs, 401(k) distributions

Free Practice Questions

Part 2: Businesses (100 Questions)

Part 2 covers business taxation and entity types:

- Business Entities - Sole proprietorships, partnerships, S corps, C corps, LLCs

- Corporate Taxation - Form 1120, taxable income, deductions, credits

- Partnership Taxation - Form 1065, distributive share, basis calculations

- S Corporation Taxation - Form 1120S, shareholder basis, distributions

- Business Deductions - Ordinary and necessary expenses, depreciation, Section 179

- Depreciation Methods - MACRS, bonus depreciation, listed property

- Business Credits - Research credit, work opportunity credit, energy credits

- Accounting Methods - Cash vs accrual, inventory methods, change of accounting

- Farm Taxation - Schedule F, farm income and expenses

- Retirement Plans for Businesses - SEP, SIMPLE, qualified plans

Part 3: Representation, Practices and Procedures (100 Questions)

Part 3 covers IRS procedures and ethics:

- Circular 230 - Rules governing practice before the IRS

- Power of Attorney - Form 2848, CAF number, representation authority

- Taxpayer Penalties - Accuracy, fraud, late filing, late payment

- Practitioner Penalties - Due diligence, unreasonable positions, preparer penalties

- Appeals Process - Collection due process, appeals conferences, Tax Court

- Collection Procedures - Liens, levies, installment agreements, OIC

- Audit Process - Correspondence, office, field audits, documentation

- Ethics and Responsibilities - Client confidentiality, conflicts of interest

- E-file Requirements - ERO, EFIN, e-services registration

- Record Retention - Document retention requirements, client files

Study Timeline

| Week | Focus | Hours |

|---|---|---|

| Week 1-4 | Part 1: Individuals | 40-50 |

| Week 5-8 | Part 2: Businesses | 40-50 |

| Week 9-11 | Part 3: Representation | 30-40 |

| Week 12 | Final review + practice exams | 20-25 |

Total: 130-165 hours recommended

Eligibility Requirements

The EA exam has no formal education requirements:

Who Can Take the EA Exam?

- No degree required

- No experience required

- Must have a valid PTIN (Preparer Tax Identification Number)

- Must not have any IRS filing delinquencies

- No disqualifying federal tax debt

After Passing

- Apply for enrollment within 1 year of passing all 3 parts

- Pass a background check (suitability)

- Pay $140 enrollment fee

- Complete 72 hours of CE every 3 years to maintain status

Tips for Success

- Take the parts in order - Part 1 builds foundation for Part 2; Part 3 is most straightforward

- Master the tax forms - Know Form 1040, 1120, 1120S, 1065, and supporting schedules

- Focus on calculations - Many questions involve computing basis, gains, deductions, and credits

- Study Circular 230 thoroughly - Part 3 is heavily tested on ethics and practice standards

- Use IRS publications - The exam is based on IRS guidance, not commercial interpretations

- Practice with time limits - 3.5 hours goes fast with 100 questions

Why Become an Enrolled Agent?

Unlimited Representation Rights

Unlike other tax professionals, EAs can represent any taxpayer on any tax matter before any IRS office.

Federal Credential

The EA credential is recognized nationwide - no state-by-state licensing required.

Growing Demand

Tax complexity continues to increase, creating strong demand for qualified tax professionals.

Career Flexibility

Work independently, for accounting firms, or with tax preparation companies.

Start Your EA Journey Today

Everything you need to pass is 100% FREE.