The Health Insurance Decision After Job Loss

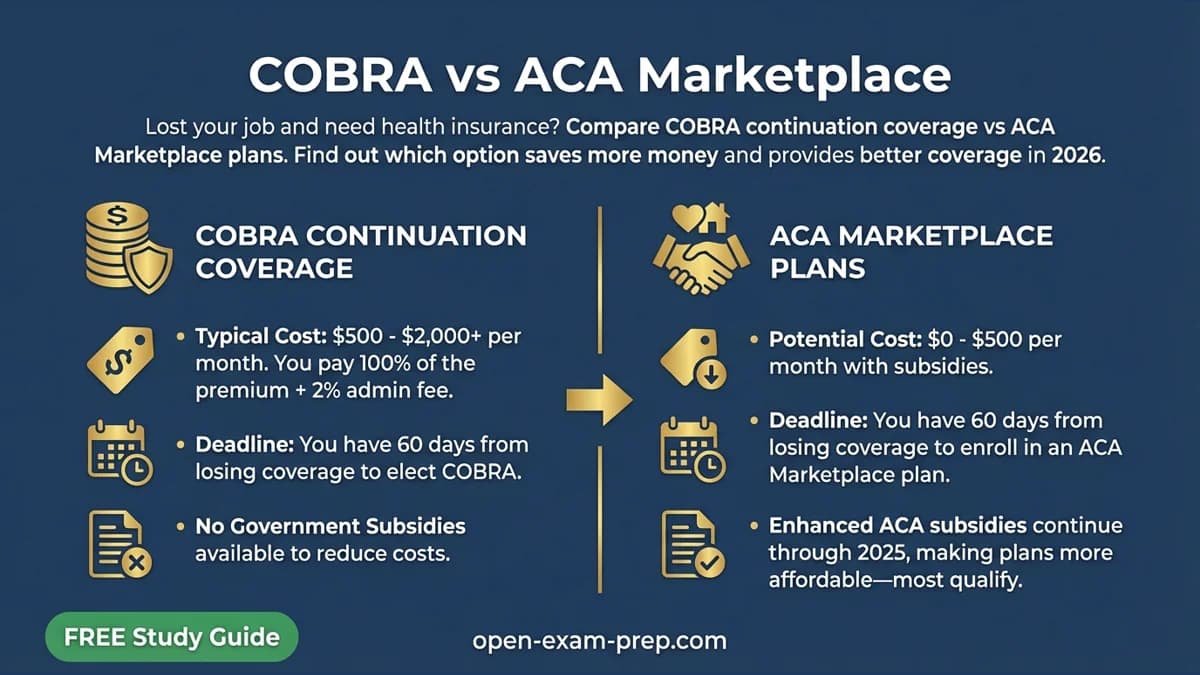

Losing your job means losing your employer health insurance—often within days. You have two main options: COBRA (continuing your employer's plan) or an ACA Marketplace plan (new individual coverage).

This decision can mean the difference between paying $2,000/month for COBRA or $200/month for a Marketplace plan with subsidies.

Key Deadline: You have 60 days from losing coverage to make this decision. Don't let this window close.

COBRA vs ACA Marketplace: Quick Comparison

| Factor | COBRA | ACA Marketplace |

|---|---|---|

| Monthly Cost | $500-$2,000+ (full premium) | $0-$500 (with subsidies) |

| Coverage | Same employer plan | New plan selection |

| Doctors | Keep existing network | May need new network |

| Enrollment Window | 60 days | 60 days (Special Enrollment) |

| Subsidies | None available | Yes, income-based |

| Duration | 18 months max | Indefinite |

Understanding COBRA Coverage

What Is COBRA?

COBRA (Consolidated Omnibus Budget Reconciliation Act) lets you continue your employer's group health insurance for up to 18 months after leaving a job. You keep the exact same plan—same doctors, same coverage.

The Catch: You Pay Everything

When employed, your employer typically pays 70-80% of your health insurance premium. With COBRA, you pay 100% of the premium, plus a 2% administrative fee.

Example COBRA Costs (2026 estimates):

| Coverage Type | Typical Monthly Cost |

|---|---|

| Individual | $600 - $900 |

| Individual + Spouse | $1,200 - $1,800 |

| Family | $1,800 - $2,400 |

When COBRA Makes Sense

✅ Choose COBRA if:

- You're mid-treatment with specific doctors/specialists

- You have a chronic condition requiring consistent care

- You've already met your deductible for the year

- Your employer plan has exceptional coverage (low deductible, low out-of-pocket max)

- You expect to get a new job with insurance within 2-3 months

- Money is not a primary concern

Understanding ACA Marketplace Plans

What Are Marketplace Plans?

The ACA (Affordable Care Act) Marketplace—also called Obamacare—offers individual health insurance plans with income-based subsidies that can dramatically reduce your cost.

The Advantage: Subsidies

Unlike COBRA, Marketplace plans offer premium tax credits based on your income. Since you just lost your job, your projected annual income is likely lower—meaning larger subsidies.

Example Marketplace Costs (2026 estimates):

| Income Level | Estimated Monthly Premium |

|---|---|

| Under 150% FPL | $0 - $50 |

| 150-200% FPL | $50 - $150 |

| 200-300% FPL | $150 - $300 |

| 300-400% FPL | $300 - $500 |

| Above 400% FPL | Full price (still often cheaper than COBRA) |

FPL = Federal Poverty Level. For 2026, 150% FPL is approximately $22,000 for an individual, $46,000 for a family of 4.

When Marketplace Makes Sense

✅ Choose Marketplace if:

- You want lower monthly costs

- You qualify for subsidies (most unemployed people do)

- You're relatively healthy and flexible on doctors

- You haven't met your deductible yet

- You're starting fresh at the beginning of the year

- Your COBRA cost is unsustainably high

📘 Not sure which to choose? Our free Layoff Handbook includes a detailed decision framework and cost calculator to help you pick the right option.

The Cost Comparison Calculator

Let's compare actual costs for a hypothetical scenario:

Scenario: 45-year-old, single, lost job in March

- Previous salary: $80,000/year

- Projected income for rest of year: $40,000 (unemployment + severance)

| Option | Monthly Premium | Deductible | Max Out-of-Pocket |

|---|---|---|---|

| COBRA | $750 | $1,500 | $6,000 |

| Silver Marketplace Plan | $180 (after subsidy) | $2,000 | $8,000 |

| Bronze Marketplace Plan | $0 (after subsidy) | $6,000 | $9,000 |

9-Month Savings (April-December):

- COBRA: $750 × 9 = $6,750

- Silver Plan: $180 × 9 = $1,620

- Savings: $5,130

Even if you use more medical care with the Silver plan's higher deductible, you'd still likely come out ahead.

2026 Marketplace Subsidies: What You Need to Know

Enhanced Subsidies Continue

The Inflation Reduction Act extended enhanced ACA subsidies through 2025. These subsidies:

- Cap premiums at 8.5% of household income (no cliff)

- Make $0 premium plans available for lower incomes

- Help middle-income families more than before

Severance & Subsidy Eligibility

Important: Severance pay counts as income for subsidy calculations. However, if your total annual income (including severance) qualifies you for subsidies, you can still benefit.

Unemployment benefits also count as income, but the total is still usually lower than your employed income, qualifying you for more help.

The 60-Day Special Enrollment Period

Both COBRA and Marketplace have a 60-day window from your coverage end date.

Timeline Example

| Event | Date |

|---|---|

| Last day of work | March 15 |

| Last day of employer coverage | March 31 |

| COBRA/SEP deadline | May 30 (60 days from March 31) |

Don't Miss the Window

If you miss the 60-day window:

- COBRA: You lose the option entirely

- Marketplace: You must wait until Open Enrollment (November-January)

Step-by-Step Decision Guide

Step 1: Get Your COBRA Costs

Your employer must send COBRA election information within 14 days of your termination. Review:

- Monthly premium amount

- What coverage options are available

- Election deadline

Step 2: Check Marketplace Options

- Go to HealthCare.gov (or your state's marketplace)

- Enter your information including projected annual income

- See available plans and subsidy amounts

- Compare total costs (premium + deductible + max out-of-pocket)

Step 3: Consider Your Healthcare Needs

| If You Have... | Consider... |

|---|---|

| Ongoing treatment with specific doctors | COBRA (to keep network) |

| Prescriptions requiring specific formulary | Compare drug coverage |

| Planned surgery this year | Check both plans' coverage |

| No major health needs | Marketplace (lower cost) |

| Already met deductible | COBRA until year-end |

Step 4: Run the Numbers

Calculate total annual cost:

COBRA: (Monthly premium × months) + deductible + expected copays

Marketplace: (Monthly premium × months) + deductible + expected copays

Don't forget:

- COBRA deductible may already be partially met

- Marketplace deductible resets

Step 5: Make Your Decision

| Choose COBRA If | Choose Marketplace If |

|---|---|

| Cost difference is minimal | Marketplace is 50%+ cheaper |

| You need specific doctors NOW | You're flexible on providers |

| Year is almost over | It's early in the year |

| You expect new job soon | Job search may take months |

Common Mistakes to Avoid

Mistake 1: Assuming COBRA Is Your Only Option

Many people don't realize they qualify for substantially cheaper Marketplace coverage. Always compare both.

Mistake 2: Missing the 60-Day Deadline

This is critical. Put a calendar reminder for day 45 to give yourself buffer time.

Mistake 3: Not Accounting for Subsidies

Your unemployed income is likely lower than your employed income. This often means larger subsidies than you'd expect.

Mistake 4: Switching COBRA to Marketplace Mid-Year

Voluntarily dropping COBRA does not trigger a Special Enrollment Period. You'd have to wait until Open Enrollment.

Mistake 5: Ignoring the Full Cost

Compare total annual healthcare costs, not just premiums:

- Premiums × 12

- Deductible

- Typical copays and coinsurance

- Maximum out-of-pocket exposure

What About Short-Term Health Insurance?

Short-term plans are cheaper but come with major drawbacks:

| Factor | Short-Term Plans |

|---|---|

| Cost | Lower premiums |

| Pre-existing conditions | Usually not covered |

| Coverage limits | Often capped |

| ACA protections | Don't apply |

| Prescription coverage | Often limited |

Our recommendation: Short-term plans should be a last resort. For most people, ACA Marketplace plans with subsidies are both more affordable AND provide better protection.

Action Items

This Week

- Gather your COBRA paperwork and note the premium

- Create a HealthCare.gov account

- Get Marketplace quotes with your projected income

- List your doctors and check both plan networks

- Calculate total annual cost for both options

Before Day 60

- Make your decision (COBRA or Marketplace)

- Enroll in your chosen plan

- Set up payment method

- Confirm coverage start date

- Keep documentation for taxes

Learn More About Post-Layoff Planning

Health insurance is just one piece of the post-layoff puzzle. Our free Layoff Handbook course covers:

- Complete COBRA vs. Marketplace decision framework

- Severance negotiation strategies

- Unemployment benefits guide

- Financial planning during job search

- Industry-specific playbooks

Access the Free Layoff Handbook →

The Bottom Line

For most people who lose their job, ACA Marketplace plans with subsidies are significantly cheaper than COBRA—often saving $500-$1,500 per month.

However, COBRA can make sense if you:

- Need specific doctors immediately

- Have already met your deductible

- Expect to find a new job very quickly

Don't default to COBRA just because it's familiar. Run the numbers on both options within your 60-day window, and make the choice that protects both your health and your finances.